Increase in Sports Participation

The rise in sports participation across various demographics in Spain is significantly impacting the sports medicine market. More individuals are engaging in recreational and competitive sports, leading to a higher incidence of sports-related injuries. According to recent statistics, approximately 40% of the Spanish population participates in some form of sport, which correlates with an increased need for sports medicine services. This trend is particularly evident among youth and amateur athletes, who often require specialized care for injuries. Consequently, healthcare providers are adapting their services to accommodate this influx of patients, thereby driving growth in the sports medicine market. The expansion of community sports programs and initiatives aimed at promoting physical activity further supports this trend, indicating a robust future for the sports medicine market in Spain.

Growing Awareness of Sports Injuries

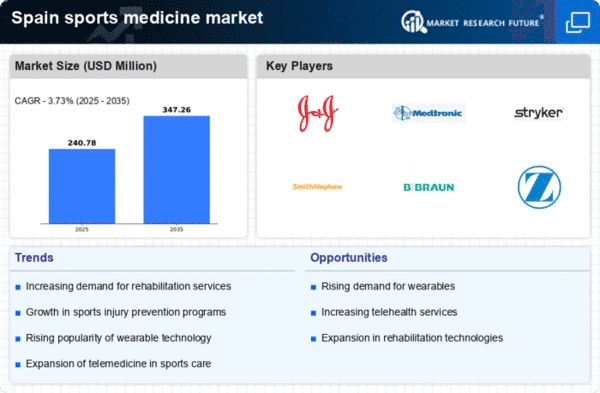

The increasing awareness of sports injuries among athletes and the general public is a key driver in the sports medicine market. Educational campaigns and media coverage have highlighted the importance of injury prevention and management. This awareness has led to a surge in demand for specialized medical services and products aimed at treating sports-related injuries. In Spain, the sports medicine market was projected to grow at a CAGR of approximately 6.5% over the next few years., driven by this heightened awareness. Athletes are now more inclined to seek professional help for injuries, which in turn boosts the market for rehabilitation services and sports medicine products. As a result, healthcare providers are expanding their offerings to cater to this growing demand, thereby enhancing the overall landscape of the sports medicine market.

Rising Popularity of Sports Technology

The growing popularity of sports technology is influencing the sports medicine market in Spain. Wearable devices, mobile applications, and telemedicine solutions are becoming integral to athlete training and injury management. These technologies provide real-time data on performance and health metrics, enabling athletes and coaches to make informed decisions regarding training regimens and injury prevention strategies. The sports medicine market is likely to benefit from this trend as more athletes adopt these technologies to enhance their performance and reduce injury risks. Furthermore, the integration of technology in rehabilitation processes is expected to streamline recovery and improve outcomes for injured athletes. As a result, the sports medicine market is poised for growth, driven by the increasing reliance on technology in sports.

Advancements in Rehabilitation Techniques

Innovations in rehabilitation techniques and technologies are transforming the sports medicine market. In Spain, the integration of advanced modalities such as cryotherapy, hydrotherapy, and biomechanical analysis is becoming increasingly common in rehabilitation programs. These advancements not only enhance recovery times but also improve the overall effectiveness of treatment protocols. As a result, healthcare facilities are investing in state-of-the-art equipment and training for medical professionals, which is likely to boost the sports medicine market. The demand for personalized rehabilitation plans tailored to individual athlete needs is also on the rise, indicating a shift towards more specialized care. This trend suggests that the sports medicine market will continue to evolve, driven by the need for effective and efficient rehabilitation solutions.

Government Support for Sports Health Initiatives

Government initiatives aimed at promoting sports health and wellness are playing a crucial role in the sports medicine market. In Spain, various programs have been launched to encourage physical activity and provide access to sports medicine services. These initiatives often include funding for sports facilities, training for healthcare professionals, and public awareness campaigns about injury prevention. Such support not only enhances the visibility of sports medicine but also increases accessibility for athletes and the general population. The Spanish government has allocated significant resources to improve sports health infrastructure, which is expected to stimulate growth in the sports medicine market. This proactive approach indicates a commitment to fostering a healthier society, ultimately benefiting the sports medicine sector.