Increased Focus on National Security

National security concerns are significantly influencing the space based-network market in Spain. The government is prioritizing the development of secure satellite communication systems to safeguard critical infrastructure and enhance defense capabilities. This focus is reflected in increased funding for military and civilian satellite projects, which are essential for intelligence gathering and emergency response. The Spanish Ministry of Defense has allocated approximately €200 million for satellite technology enhancements over the next three years. This investment is likely to stimulate growth in the space based-network market, as defense contractors and technology providers seek to fulfill government requirements. The emphasis on security is expected to drive innovation and create new market opportunities.

Rising Demand for Internet Connectivity

In Spain, the demand for reliable internet connectivity is driving the growth of the space based-network market. With the increasing reliance on digital services, especially in rural and remote areas, satellite internet solutions are becoming essential. The Spanish government has initiated programs aimed at bridging the digital divide, which includes investments in satellite infrastructure. Reports suggest that approximately 30% of the Spanish population still lacks access to high-speed internet, highlighting a significant market opportunity. As a result, companies are focusing on deploying satellite networks to meet this demand, potentially increasing market revenues by €500 million by 2027. This trend underscores the critical role of satellite technology in enhancing connectivity across the nation.

Strategic Partnerships and Collaborations

The space based-network market in Spain is witnessing a trend towards strategic partnerships and collaborations among various stakeholders. Companies are increasingly joining forces with governmental agencies, research institutions, and international organizations to leverage expertise and resources. These collaborations are aimed at developing innovative satellite solutions and expanding service offerings. For instance, partnerships between Spanish satellite operators and technology firms are facilitating the deployment of next-generation satellite systems. This collaborative approach is expected to enhance the competitive landscape, potentially leading to a market growth rate of 10% annually. Such alliances not only foster innovation but also contribute to the overall advancement of the space based-network market.

Growing Interest in Earth Observation Applications

The space based-network market in Spain is benefiting from a growing interest in Earth observation applications. Various sectors, including agriculture, environmental monitoring, and urban planning, are increasingly utilizing satellite data for decision-making. The Spanish government has recognized the value of Earth observation and is investing in satellite systems that provide critical data for climate change analysis and resource management. Reports indicate that the market for Earth observation services is expected to reach €1 billion by 2028, driven by the demand for accurate and timely information. This trend highlights the potential for growth within the space based-network market, as more organizations seek to harness satellite technology for diverse applications.

Technological Advancements in Satellite Communication

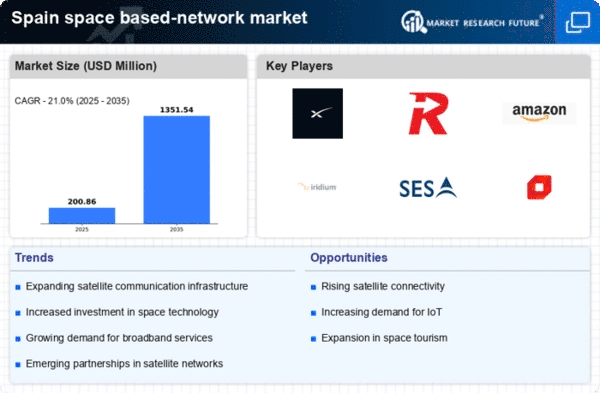

The space based-network market in Spain is experiencing a surge due to rapid technological advancements in satellite communication. Innovations in high-throughput satellites (HTS) and low Earth orbit (LEO) systems are enhancing data transmission capabilities. This evolution is expected to increase bandwidth availability, thereby attracting various sectors such as telecommunications and broadcasting. The Spanish government has recognized the potential of these technologies, leading to increased funding for research and development. As a result, the market is projected to grow at a CAGR of approximately 12% over the next five years, indicating a robust demand for advanced satellite communication solutions. This growth is likely to create new opportunities for service providers and manufacturers within the space based-network market.