Rising Demand for Renewable Energy

In Spain, the increasing demand for renewable energy sources is a crucial driver for the smart grid-networking market. With Spain's commitment to achieving 74% of its electricity generation from renewable sources by 2030, the need for advanced grid solutions becomes paramount. Smart grids facilitate the integration of solar, wind, and other renewable energies, ensuring a stable and reliable energy supply. The market is expected to witness a surge in investments, with estimates suggesting that over €30 billion will be allocated to renewable energy projects in the coming years. This shift towards renewables not only enhances energy security but also aligns with the European Union's broader sustainability goals, thereby propelling the smart grid-networking market forward.

Government Initiatives and Policies

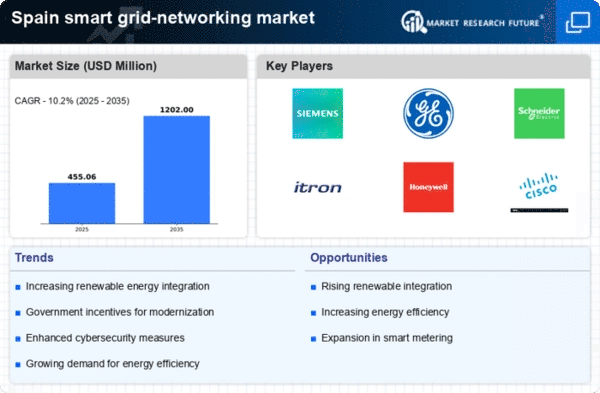

Government initiatives aimed at modernizing energy infrastructure significantly influence the smart grid-networking market in Spain. The Spanish government has implemented various policies to promote renewable energy integration and enhance grid efficiency. For instance, the National Integrated Energy and Climate Plan (PNIEC) outlines ambitious targets for reducing greenhouse gas emissions by 23% by 2030. This regulatory framework encourages investments in smart grid technologies, which are essential for managing distributed energy resources. As a result, the market is projected to grow at a CAGR of approximately 15% over the next five years, driven by these supportive policies. Furthermore, the government is likely to allocate substantial funding to research and development in smart grid solutions, thereby fostering innovation and competitiveness in the industry.

Increased Focus on Energy Efficiency

The growing emphasis on energy efficiency in Spain is a pivotal factor driving the smart grid-networking market. As energy costs continue to rise, both consumers and businesses are seeking solutions to reduce their energy consumption. Smart grid technologies enable better energy management through real-time monitoring and analytics, allowing users to identify inefficiencies and optimize usage. The Spanish government has set ambitious energy efficiency targets, aiming for a 39% reduction in energy consumption by 2030. This focus on efficiency is likely to stimulate investments in smart grid solutions, with the market expected to grow by approximately 10% over the next few years. Consequently, energy efficiency initiatives are not only beneficial for consumers but also contribute to the overall sustainability goals of the country.

Growing Urbanization and Population Density

Growing urbanization and increasing population density in Spain significantly drive the smart grid-networking market. As urban areas expand, the demand for reliable and efficient energy distribution systems intensifies. Smart grids are essential for managing the complexities of urban energy needs, including peak load management and integration of electric vehicles. With urban populations projected to reach 85% by 2030, the pressure on existing infrastructure necessitates the adoption of smart grid technologies. This urban shift is likely to result in a market growth rate of around 14% as cities invest in modernizing their energy systems to accommodate future demands. The smart grid-networking market thus plays a crucial role in supporting sustainable urban development.

Technological Advancements in Communication

Technological advancements in communication technologies are reshaping the smart grid-networking market in Spain. Innovations such as Internet of Things (IoT) and 5G connectivity are enabling real-time data exchange between utilities and consumers. These technologies enhance grid management, improve energy efficiency, and facilitate demand response programs. The integration of smart meters and advanced communication networks allows for better monitoring and control of energy consumption. As a result, the market is likely to expand, with projections indicating a growth rate of around 12% annually. This technological evolution not only optimizes energy distribution but also empowers consumers to make informed decisions regarding their energy usage, thus driving the overall market growth.