Growing Focus on Quality Assurance

Quality assurance is becoming increasingly important in the renting leasing-test-measurement-equipment market in Spain. As industries strive to meet stringent quality standards, the demand for reliable testing and measurement equipment is on the rise. Companies are more inclined to rent high-quality equipment to ensure compliance with regulatory requirements and enhance product reliability. This trend is particularly evident in sectors such as pharmaceuticals and manufacturing, where precision is paramount. The emphasis on quality assurance is likely to drive rental services, as businesses seek to mitigate risks associated with equipment failure. Consequently, the focus on quality assurance is a significant driver shaping the renting leasing-test-measurement-equipment market.

Cost Efficiency and Budget Management

Cost efficiency remains a pivotal driver in the renting leasing-test-measurement-equipment market in Spain. Businesses are increasingly recognizing the financial advantages of renting equipment rather than making substantial capital expenditures. This approach allows companies to allocate resources more effectively, particularly in industries with fluctuating demand. For instance, firms can save up to 40% on equipment costs by opting for rental solutions. Additionally, renting provides access to the latest technology without the burden of depreciation. This financial flexibility is particularly appealing to small and medium-sized enterprises, which constitute a significant portion of the market. Thus, cost efficiency is a crucial factor influencing the growth of the renting leasing-test-measurement-equipment market.

Increased Demand for Flexible Solutions

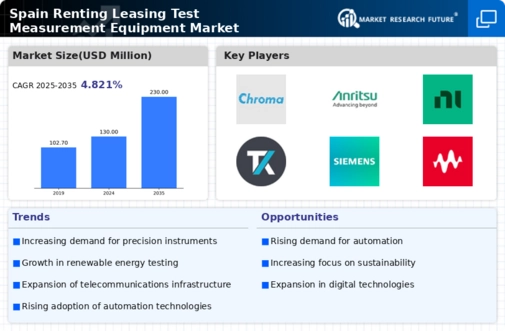

The renting leasing-test-measurement-equipment market in Spain is experiencing a notable surge in demand for flexible solutions. Companies are increasingly opting for rental services to avoid the high upfront costs associated with purchasing equipment. This trend is particularly pronounced in sectors such as telecommunications and construction, where the need for advanced testing and measurement tools is critical. According to recent data, the rental market is projected to grow at a CAGR of approximately 8% over the next five years. This shift towards flexibility allows businesses to adapt quickly to changing project requirements without the burden of long-term investments, thereby enhancing operational efficiency in the renting leasing-test-measurement-equipment market.

Technological Advancements Driving Innovation

Technological advancements are significantly influencing the renting leasing-test-measurement-equipment market in Spain. The integration of cutting-edge technologies such as IoT and AI into testing equipment is enhancing the capabilities and functionalities of rental products. This innovation not only improves accuracy and efficiency but also reduces downtime for users. As a result, companies are more inclined to rent advanced equipment rather than invest in outdated models. The market is witnessing a shift where approximately 30% of businesses prefer renting over purchasing due to the rapid pace of technological change. This trend indicates a growing reliance on rental services within the renting leasing-test-measurement-equipment market.

Environmental Considerations and Sustainability

Environmental considerations are increasingly influencing the renting leasing-test-measurement-equipment market in Spain. As businesses become more aware of their ecological footprint, there is a growing preference for rental solutions that promote sustainability. Renting equipment reduces waste and encourages the efficient use of resources, aligning with corporate social responsibility goals. Moreover, companies are more likely to choose rental services that offer eco-friendly equipment options. This trend is expected to gain momentum, with a projected increase in demand for sustainable rental solutions by approximately 25% over the next few years. Thus, environmental considerations are emerging as a vital driver in the renting leasing-test-measurement-equipment market.