Investment in Healthcare Infrastructure

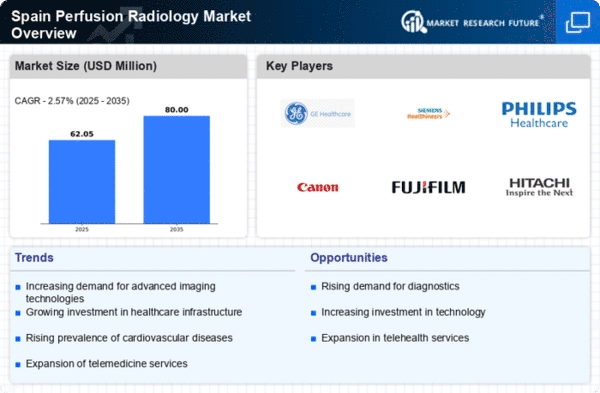

The Spanish government has been actively investing in healthcare infrastructure, which is positively influencing the perfusion radiology market. Recent initiatives aimed at modernizing hospitals and healthcare facilities have led to the acquisition of advanced imaging technologies. For instance, the introduction of state-of-the-art MRI and CT machines has enhanced diagnostic capabilities, allowing for more accurate assessments of perfusion. Reports indicate that healthcare spending in Spain is projected to increase by approximately 5% annually, with a significant portion allocated to radiology services. This investment not only improves patient outcomes but also stimulates growth within the perfusion radiology market, as facilities upgrade their equipment and expand service offerings.

Rising Demand for Non-Invasive Procedures

The increasing preference for non-invasive diagnostic techniques is driving the perfusion radiology market in Spain. Patients and healthcare providers are gravitating towards methods that minimize discomfort and recovery time. Non-invasive imaging techniques, such as MRI and CT perfusion, are gaining traction due to their ability to provide detailed insights without the need for surgical intervention. This shift is reflected in the growing number of procedures performed, with estimates suggesting a rise of approximately 15% in non-invasive imaging utilization over the past few years. As healthcare facilities adopt these technologies, the perfusion radiology market is likely to expand, catering to the evolving needs of patients and practitioners alike.

Growing Awareness of Early Disease Detection

There is a notable increase in awareness regarding the importance of early disease detection among both healthcare professionals and the general public in Spain. This heightened awareness is driving the demand for advanced imaging techniques, including those utilized in the perfusion radiology market. Educational campaigns and initiatives by health organizations have emphasized the benefits of early diagnosis, particularly in conditions such as stroke and cancer. As a result, healthcare providers are increasingly incorporating perfusion imaging into routine diagnostic protocols. This trend is likely to contribute to a sustained growth trajectory for the perfusion radiology market, as more patients seek timely and effective diagnostic solutions.

Aging Population and Associated Health Issues

Spain's demographic trends indicate a significant increase in the aging population, which is expected to impact the perfusion radiology market substantially. As individuals age, the prevalence of cardiovascular diseases and other health conditions rises, necessitating advanced imaging techniques for accurate diagnosis and treatment planning. The World Health Organization projects that by 2030, nearly 25% of Spain's population will be over 65 years old. This demographic shift is likely to drive demand for perfusion imaging services, as healthcare providers seek to address the complex health needs of older patients. Consequently, the perfusion radiology market is poised for growth, aligning with the increasing healthcare demands of this demographic.

Technological Integration in Healthcare Systems

The integration of advanced technologies into healthcare systems is transforming the landscape of the perfusion radiology market in Spain. The adoption of artificial intelligence (AI) and machine learning algorithms in imaging analysis is enhancing diagnostic accuracy and efficiency. These technologies assist radiologists in interpreting complex data, leading to quicker and more reliable results. Furthermore, the interoperability of imaging systems with electronic health records (EHR) facilitates seamless data sharing among healthcare providers. This integration is expected to streamline workflows and improve patient care, thereby driving growth in the perfusion radiology market. As healthcare facilities continue to embrace these innovations, the demand for perfusion imaging services is likely to rise.