Advancements in Implant Materials

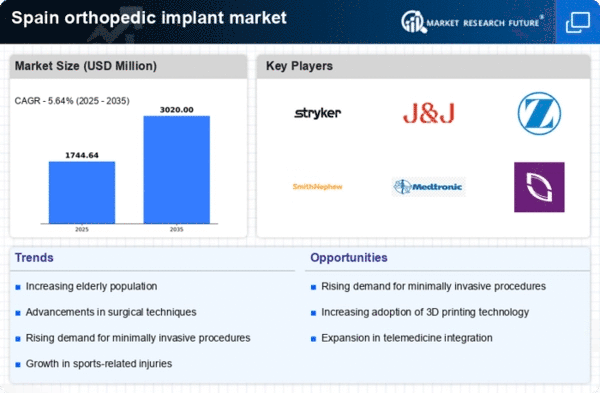

The orthopedic implant market in Spain is witnessing a transformation due to advancements in implant materials. Innovations in biocompatible materials, such as titanium alloys and polymers, enhance the performance and longevity of implants. These materials reduce the risk of complications and improve patient satisfaction, which is crucial in a competitive healthcare environment. The market for orthopedic implants is projected to grow at a CAGR of 6% over the next five years, driven by these technological advancements. As manufacturers invest in research and development, the orthopedic implant market is likely to see a wider array of products that cater to diverse patient needs, ultimately improving surgical outcomes.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure in Spain significantly impact the orthopedic implant market. The Spanish government has allocated substantial funding to enhance orthopedic services, which includes the procurement of advanced implant technologies. Recent budgets indicate an increase of 15% in healthcare spending, with a portion dedicated to orthopedic care. This financial support facilitates the adoption of cutting-edge implants and surgical techniques, thereby enhancing patient care. Furthermore, public health campaigns aimed at raising awareness about orthopedic health are likely to drive demand for implants, as more individuals seek treatment for their conditions. The orthopedic implant market stands to benefit from these proactive measures.

Rise of Outpatient Surgical Procedures

The orthopedic implant market in Spain is experiencing a shift towards outpatient surgical procedures, which is reshaping the landscape of orthopedic care. Advances in surgical techniques and anesthesia have made it feasible for many procedures to be performed on an outpatient basis, reducing hospital stays and associated costs. This trend is appealing to both patients and healthcare providers, as it enhances patient convenience and optimizes resource utilization. The orthopedic implant market is likely to see increased demand for implants that are specifically designed for outpatient procedures, as this approach becomes more prevalent in the healthcare system.

Rising Incidence of Orthopedic Disorders

The orthopedic implant market in Spain experiences growth due to the increasing prevalence of orthopedic disorders such as osteoarthritis and fractures. According to recent health statistics, approximately 20% of the Spanish population suffers from some form of musculoskeletal disorder, leading to a higher demand for orthopedic implants. This trend is particularly pronounced among the elderly, who are more susceptible to these conditions. The rising incidence of sports-related injuries among younger populations also contributes to the demand for implants. As healthcare providers focus on improving patient outcomes, the orthopedic implant market is likely to see a surge in innovative implant designs and materials that cater to these growing needs.

Increasing Awareness of Orthopedic Health

There is a growing awareness of orthopedic health issues among the Spanish population, which is positively influencing the orthopedic implant market. Educational campaigns and community health programs have been instrumental in informing individuals about the importance of early diagnosis and treatment of orthopedic conditions. This heightened awareness is leading to an increase in consultations and subsequent surgical interventions, thereby driving demand for orthopedic implants. The orthopedic implant market is likely to benefit from this trend as more patients seek solutions for their orthopedic problems, resulting in a more proactive approach to healthcare.