Growing Urbanization

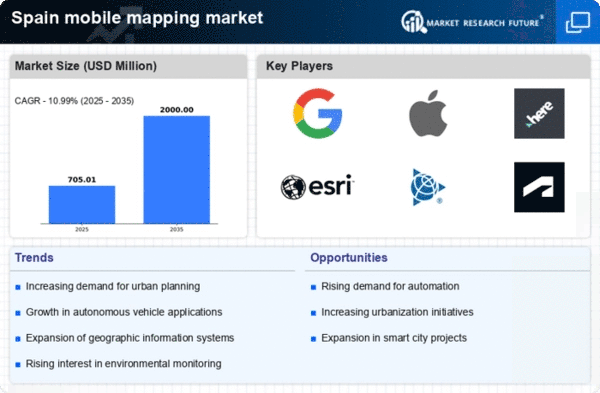

The rapid urbanization in Spain is a pivotal driver for the mobile mapping market. As cities expand, the demand for accurate geospatial data increases, facilitating urban planning and infrastructure development. The mobile mapping market is witnessing a surge in applications such as road mapping, asset management, and urban analytics. According to recent data, urban areas in Spain are projected to grow by approximately 10% by 2030, necessitating advanced mapping solutions. This growth compels local governments and private sectors to invest in mobile mapping technologies to enhance their operational efficiency and decision-making processes. Consequently, the mobile mapping market is likely to experience significant growth as stakeholders seek innovative solutions to manage urban challenges effectively.

Government Initiatives and Funding

Government initiatives in Spain aimed at enhancing digital infrastructure are significantly influencing the mobile mapping market. The Spanish government has allocated substantial funding for smart city projects, which often rely on precise geospatial data. For instance, the Smart Cities initiative promotes the integration of technology in urban management, thereby increasing the demand for mobile mapping solutions. Reports indicate that public investment in digital infrastructure is expected to reach €1 billion by 2026, creating a favorable environment for the mobile mapping market. This financial support encourages the development and adoption of advanced mapping technologies, positioning Spain as a leader in the European mobile mapping landscape.

Increased Demand for Real-Time Data

The growing demand for real-time data in various sectors is a significant driver for the mobile mapping market in Spain. Industries such as logistics, transportation, and emergency services require up-to-date geospatial information to optimize their operations. Mobile mapping technologies provide real-time mapping solutions that enhance situational awareness and decision-making. The mobile mapping market is responding to this demand by developing systems that offer live data updates and integration with other technologies. As businesses and government agencies recognize the value of real-time data, the mobile mapping market is poised for growth, with projections indicating a potential increase in market size by 15% over the next five years.

Rising Adoption of Autonomous Vehicles

The increasing adoption of autonomous vehicles in Spain is driving the mobile mapping market forward. As automotive manufacturers and tech companies invest in self-driving technology, the need for high-resolution mapping data becomes critical. Mobile mapping systems provide the necessary geospatial information to support navigation and safety features in autonomous vehicles. The mobile mapping market is likely to benefit from this trend, as it aligns with the broader shift towards automation in transportation. Industry analysts suggest that the autonomous vehicle market in Spain could reach €5 billion by 2030, further propelling the demand for mobile mapping solutions that ensure accurate and reliable data for vehicle operation.

Advancements in Data Processing Technologies

Advancements in data processing technologies are reshaping the mobile mapping market in Spain. The emergence of artificial intelligence (AI) and machine learning (ML) has enhanced the capabilities of mobile mapping systems, allowing for faster and more accurate data analysis. These technologies enable the extraction of valuable insights from vast datasets, which is crucial for applications such as urban planning and environmental monitoring. The mobile mapping market is likely to see increased adoption of AI-driven solutions, as organizations seek to leverage data for strategic decision-making. As processing capabilities improve, the efficiency and effectiveness of mobile mapping applications are expected to rise, attracting more users and investments.