Focus on Environmental Monitoring

The Spain mid wave infrared sensors market is increasingly focused on environmental monitoring, driven by growing concerns over air quality and climate change. Mid wave infrared sensors are essential for detecting greenhouse gases and pollutants, making them valuable tools for environmental agencies and research institutions. The Spanish government has implemented various policies aimed at improving environmental monitoring capabilities, which may boost the demand for these sensors. For example, initiatives to monitor emissions from industrial facilities and urban areas are likely to create opportunities for sensor manufacturers. This focus on environmental sustainability aligns with global trends and may position Spain as a leader in the development of advanced monitoring technologies.

Growing Demand in Security and Defense

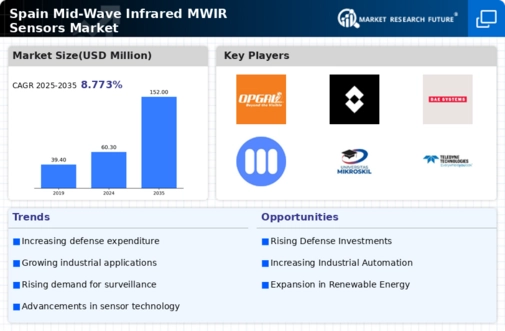

The Spain mid wave infrared sensors market is experiencing a growing demand in the security and defense sectors. These sensors are crucial for surveillance, threat detection, and reconnaissance applications. The Spanish government has been increasing its defense budget, which may lead to enhanced procurement of advanced sensor technologies. Recent reports indicate that defense spending in Spain is expected to rise by 3% annually, potentially driving the demand for mid wave infrared sensors. As security concerns continue to evolve, the integration of these sensors into defense systems is likely to become more prevalent, further expanding the market.

Technological Advancements in Sensor Design

The Spain mid wave infrared sensors market is experiencing a surge in technological advancements that enhance sensor performance and reliability. Innovations in materials and manufacturing processes have led to the development of sensors with improved sensitivity and resolution. For instance, the integration of advanced semiconductor materials has enabled the production of sensors that operate effectively in diverse environmental conditions. This trend is likely to drive market growth, as industries increasingly seek high-performance sensors for applications such as thermal imaging and gas detection. Furthermore, the Spanish government has been investing in research and development initiatives aimed at fostering innovation in sensor technologies, which may further stimulate the market.

Regulatory Support and Standards Development

The Spain mid wave infrared sensors market benefits from regulatory support and the development of standards that promote the use of advanced sensor technologies. The Spanish government, in collaboration with European Union initiatives, is working to establish guidelines that ensure the quality and reliability of infrared sensors. This regulatory framework may encourage manufacturers to innovate and improve their products, thereby enhancing market competitiveness. Additionally, compliance with these standards can facilitate market entry for new players, potentially increasing the overall market size. As regulations evolve, the Spain mid wave infrared sensors market is likely to adapt, fostering growth and technological advancement.

Increased Adoption in Industrial Applications

The Spain mid wave infrared sensors market is witnessing increased adoption across various industrial applications, particularly in sectors such as manufacturing, automotive, and aerospace. The demand for precise temperature measurement and monitoring in these industries is driving the need for mid wave infrared sensors. According to recent data, the industrial sector in Spain is projected to grow at a compound annual growth rate of 4.5% over the next five years, which may lead to a corresponding increase in sensor demand. Additionally, the push for automation and smart manufacturing practices is likely to further propel the integration of mid wave infrared sensors in industrial processes, enhancing operational efficiency and safety.