Rising Healthcare Expenditure

The upward trend in healthcare expenditure in Spain is positively impacting the metered dose-inhalers market. As the government and private sectors invest more in healthcare services, there is a corresponding increase in the availability and accessibility of medical treatments, including inhalation therapies. The metered dose-inhalers market is likely to benefit from this trend, as higher healthcare spending facilitates the procurement of advanced inhalation devices and medications. Furthermore, increased funding for healthcare initiatives allows for better patient education and support, which can enhance adherence to treatment regimens. As healthcare expenditure continues to rise, the metered dose-inhalers market is expected to expand, driven by improved access to essential respiratory care.

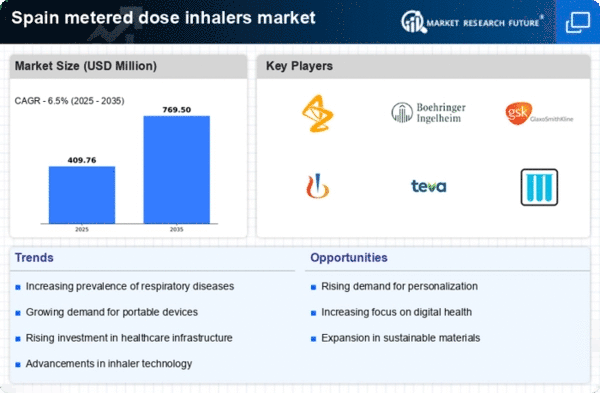

Advancements in Inhaler Technology

Technological innovations in inhaler design and functionality are significantly influencing the metered dose-inhalers market. Recent developments include the introduction of smart inhalers equipped with digital tracking capabilities, which enhance patient adherence to prescribed therapies. These devices can monitor usage patterns and provide feedback, thereby improving treatment outcomes. The metered dose-inhalers market in Spain is witnessing a shift towards these advanced inhalation devices, which are expected to capture a larger market share. Additionally, the integration of environmentally friendly propellants in inhalers aligns with sustainability trends, appealing to environmentally conscious consumers. As technology continues to evolve, the market is poised for further expansion, driven by the demand for more effective and user-friendly inhalation solutions.

Government Initiatives and Funding

Government initiatives aimed at improving respiratory health are playing a crucial role in the metered dose-inhalers market. In Spain, public health campaigns and funding for respiratory disease management are increasing, which directly supports the growth of the metered dose-inhalers market. The Spanish government has allocated substantial resources to enhance healthcare infrastructure and promote awareness about respiratory conditions. This includes funding for research and development of new inhalation therapies, which is likely to stimulate market growth. Furthermore, initiatives to subsidize the cost of inhalers for patients can enhance accessibility, encouraging more individuals to seek treatment. As a result, the metered dose-inhalers market is expected to benefit from these supportive measures, leading to increased adoption of inhalation devices.

Growing Focus on Preventive Healthcare

The shift towards preventive healthcare in Spain is emerging as a significant driver for the metered dose-inhalers market. With an increasing emphasis on early diagnosis and management of respiratory diseases, healthcare providers are advocating for proactive treatment approaches. This trend is likely to lead to higher demand for metered dose-inhalers, as they are essential for managing chronic conditions effectively. The metered dose-inhalers market is expected to see growth as patients become more engaged in their health management, seeking out inhalation therapies as part of their preventive care strategies. Additionally, educational programs aimed at informing the public about the importance of managing respiratory health are likely to further boost market demand.

Rising Prevalence of Respiratory Diseases

The increasing incidence of respiratory diseases in Spain is a primary driver for the metered dose-inhalers market. Conditions such as asthma and chronic obstructive pulmonary disease (COPD) are becoming more prevalent, affecting a significant portion of the population. According to recent health statistics, approximately 5.5 million individuals in Spain suffer from asthma, while COPD affects around 2.5 million. This growing patient base necessitates effective treatment options, thereby propelling the demand for metered dose-inhalers. The metered dose-inhalers market is likely to experience substantial growth as healthcare providers seek to offer innovative inhalation therapies to manage these chronic conditions. Furthermore, the aging population in Spain, which is more susceptible to respiratory ailments, further amplifies the need for accessible and efficient inhalation devices.