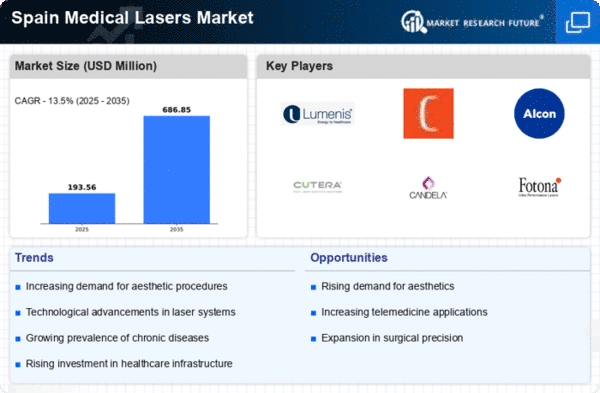

Growth in Aesthetic Procedures

The medical lasers market in Spain is significantly influenced by the growing interest in aesthetic procedures. With an increasing number of individuals seeking non-invasive cosmetic treatments, the demand for laser technologies has surged. Reports indicate that the aesthetic segment of the medical lasers market is projected to grow at a CAGR of approximately 10% over the next few years. This growth is attributed to the rising awareness of aesthetic treatments, coupled with advancements in laser technology that offer safer and more effective options. As consumers become more conscious of their appearance, the medical lasers market is likely to expand, driven by innovations in laser applications for skin rejuvenation, hair removal, and other cosmetic enhancements.

Rising Awareness of Laser Treatments

Rising awareness of the benefits of laser treatments is significantly impacting the medical lasers market in Spain. Educational campaigns and increased media coverage have contributed to a better understanding of how laser technologies can improve health outcomes. Patients are becoming more informed about the advantages of laser procedures, such as reduced recovery times and minimal invasiveness. This heightened awareness is likely to drive demand for medical lasers across various applications, including dermatology, ophthalmology, and surgical procedures. As more individuals seek out these treatments, healthcare providers are expected to invest in advanced laser systems, further propelling the growth of the medical lasers market. This trend indicates a shift towards patient-centered care, where informed choices lead to increased utilization of laser technologies.

Investment in Healthcare Infrastructure

Investment in healthcare infrastructure in Spain is a crucial driver for the medical lasers market. The Spanish government has been increasing its healthcare budget, focusing on modernizing facilities and integrating advanced technologies. This investment is expected to enhance the availability of medical lasers in hospitals and clinics, facilitating better access to cutting-edge treatments. As healthcare facilities upgrade their equipment, the adoption of medical lasers is likely to rise, reflecting a commitment to improving patient care. Furthermore, the influx of funding for research and development in medical technologies may lead to the introduction of innovative laser systems, thereby expanding the medical lasers market. This trend suggests a positive outlook for the industry as healthcare providers seek to enhance their service offerings.

Increasing Prevalence of Chronic Diseases

The medical lasers market in Spain is experiencing growth due to the rising prevalence of chronic diseases such as diabetes and cardiovascular conditions. These diseases often require advanced treatment options, including laser therapies for effective management. According to recent health statistics, chronic diseases account for a significant portion of healthcare expenditures, prompting healthcare providers to adopt innovative solutions. The integration of medical lasers in treatment protocols not only enhances patient outcomes but also reduces recovery times. As the population ages, the demand for effective and minimally invasive treatment options is likely to increase, further driving the medical lasers market. This trend indicates a shift towards more sophisticated healthcare solutions, positioning medical lasers as a vital component in the management of chronic conditions.

Technological Innovations in Laser Systems

Technological innovations in laser systems are a pivotal driver for the medical lasers market in Spain. Continuous advancements in laser technology, such as the development of more precise and efficient laser devices, are enhancing treatment efficacy and safety. Innovations like fractional laser systems and picosecond lasers are gaining traction, offering improved outcomes for patients. The introduction of these advanced systems is likely to attract more healthcare providers to incorporate laser treatments into their practice. Furthermore, the integration of artificial intelligence and machine learning in laser applications may streamline procedures and enhance patient experiences. As these technologies evolve, the medical lasers market is expected to expand, reflecting a commitment to providing state-of-the-art healthcare solutions.