Shift Towards Remote Work

The shift towards remote work in Spain has significantly impacted the managed detection-response market. As organizations adapt to flexible work arrangements, the attack surface has expanded, making it more challenging to secure networks and data. This transition has led to an increased reliance on managed detection-response services to monitor and protect remote endpoints. In 2025, it is estimated that 30% of the Spanish workforce will continue to work remotely, necessitating robust security measures. Consequently, businesses are investing in managed detection-response solutions to ensure continuous monitoring and rapid incident response. This trend is expected to drive market growth at a rate of 13% annually, as organizations seek to mitigate risks associated with remote work and maintain operational continuity.

Rising Cyber Threat Landscape

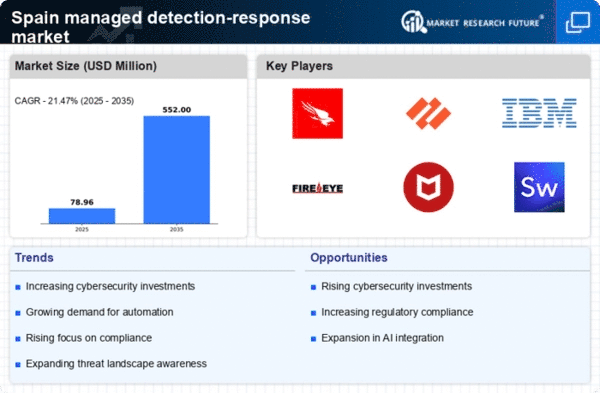

The managed detection-response market is experiencing growth due to an escalating cyber threat landscape. With cyberattacks becoming more sophisticated, organizations are increasingly seeking advanced security solutions. In 2025, it is estimated that cybercrime could cost the global economy over $10 trillion annually, prompting Spanish businesses to invest in managed detection-response services. This market is projected to grow at a CAGR of 15% from 2025 to 2030, as companies recognize the necessity of robust security measures. The increasing frequency of data breaches and ransomware attacks has heightened awareness among organizations, leading to a surge in demand for managed detection-response market services. Consequently, cybersecurity firms are expanding their offerings to include comprehensive detection and response capabilities, ensuring that businesses can effectively mitigate risks and protect sensitive information.

Regulatory Compliance Requirements

In Spain, stringent regulatory compliance requirements are driving the managed detection-response market. Organizations are mandated to adhere to various data protection laws, such as the General Data Protection Regulation (GDPR). Non-compliance can result in hefty fines, reaching up to €20 million or 4% of annual global turnover, whichever is higher. As a result, businesses are increasingly turning to managed detection-response services to ensure compliance with these regulations. The managed detection-response market is expected to see a growth rate of approximately 12% annually as companies prioritize compliance and risk management. This trend indicates a shift towards proactive security measures, as organizations recognize that effective detection and response capabilities are essential for meeting regulatory standards and safeguarding customer data.

Increased Investment in Cybersecurity

The managed detection-response market is benefiting from increased investment in cybersecurity. In recent years, Spanish companies have allocated a larger portion of their IT budgets to cybersecurity initiatives, with spending projected to reach €1.5 billion by 2026. This trend reflects a growing recognition of the importance of cybersecurity in protecting business assets and maintaining customer trust. As organizations face mounting pressure to defend against cyber threats, the demand for managed detection-response services is likely to rise. The market is expected to expand at a CAGR of 14% over the next five years, driven by the need for advanced threat detection and rapid response capabilities. This investment surge indicates a commitment to enhancing security postures and ensuring resilience against evolving cyber threats.

Growing Awareness of Cybersecurity Risks

There is a growing awareness of cybersecurity risks among organizations in Spain, which is positively influencing the managed detection-response market. As high-profile data breaches and cyber incidents make headlines, businesses are becoming more cognizant of the potential consequences of inadequate security measures. This heightened awareness is prompting organizations to prioritize cybersecurity investments, with the managed detection-response market projected to grow by 11% annually. Companies are increasingly recognizing that proactive detection and response capabilities are essential for safeguarding sensitive information and maintaining customer trust. This trend indicates a shift in mindset, as organizations move from reactive to proactive security strategies, thereby driving demand for managed detection-response services.