Emergence of New Content Providers

The emergence of new content providers in Spain is reshaping the landscape of the lte 5g-broadcast market. As traditional media companies face competition from digital platforms, new entrants are leveraging 5G technology to deliver innovative content experiences. This shift is evidenced by the rise of streaming services that focus on niche markets, which are increasingly utilizing the capabilities of the lte 5g-broadcast market to reach their audiences. The ability to broadcast high-quality content efficiently allows these providers to differentiate themselves in a crowded marketplace. As consumer preferences evolve, the lte 5g-broadcast market is expected to adapt, fostering a dynamic environment that encourages creativity and competition among content creators.

Rising Popularity of Mobile Gaming

The rising popularity of mobile gaming in Spain is emerging as a significant driver for the lte 5g-broadcast market. With mobile gaming revenues projected to reach €1.5 billion by 2026, the demand for high-speed, low-latency connections is paramount. The lte 5g-broadcast market is well-positioned to cater to this demand, as it can facilitate real-time broadcasting of gaming content to a vast audience. This capability enhances the gaming experience, allowing for seamless multiplayer interactions and live streaming of gameplay. As the gaming community continues to expand, the lte 5g-broadcast market is likely to see increased adoption and investment, further solidifying its role in the entertainment ecosystem.

Expansion of Smart City Initiatives

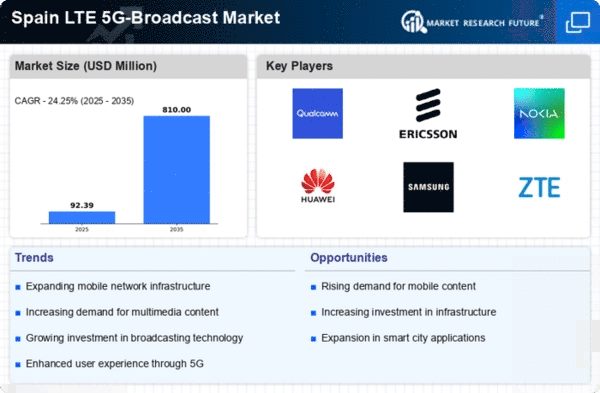

The expansion of smart city initiatives across Spain serves as a significant catalyst for the lte 5g-broadcast market. Municipalities are increasingly adopting advanced technologies to improve urban living, which includes the deployment of 5G networks for enhanced connectivity. The Spanish government has allocated substantial funding, estimated at €1 billion, to support smart city projects, which often incorporate broadcasting capabilities for real-time data dissemination. This integration allows for improved public services, such as traffic management and emergency response systems, leveraging the lte 5g-broadcast market to deliver critical information efficiently. As cities evolve into smart ecosystems, the demand for robust broadcasting solutions is expected to rise, further propelling the growth of the lte 5g-broadcast market.

Growing Demand for High-Quality Streaming

The increasing consumer demand for high-quality streaming services is a pivotal driver for the lte 5g-broadcast market. In Spain, the proliferation of smart devices and high-definition content has led to a surge in data consumption. Reports indicate that mobile data traffic in Spain is expected to grow by over 40% annually, necessitating advanced broadcasting solutions. The lte 5g-broadcast market is poised to benefit from this trend, as it enables efficient delivery of high-definition video and audio content to a large audience simultaneously. This capability not only enhances user experience but also supports content providers in reaching wider demographics, thereby driving revenue growth. As consumers increasingly seek seamless streaming experiences, the lte 5g-broadcast market is likely to see substantial investment and innovation to meet these evolving demands.

Increased Investment in Telecommunications Infrastructure

In Spain, the telecommunications sector is witnessing increased investment aimed at enhancing infrastructure, which is a crucial driver for the lte 5g-broadcast market. The Spanish government, in collaboration with private entities, has committed to investing over €5 billion in 5G infrastructure by 2025. This investment is expected to facilitate the rollout of advanced broadcasting technologies, enabling more efficient content delivery and improved network reliability. The lte 5g-broadcast market stands to gain from this influx of capital, as it allows for the development of innovative broadcasting solutions that can cater to the growing needs of consumers and businesses alike. Enhanced infrastructure not only supports existing services but also paves the way for new applications, thereby expanding the market's potential.