Rising Prevalence of IBS

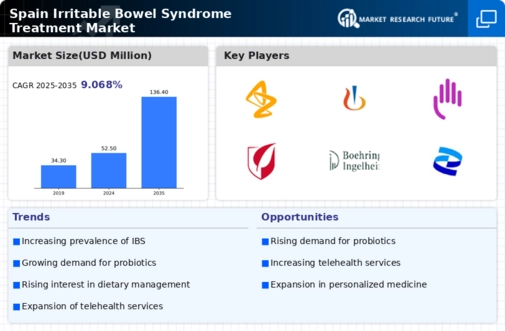

The increasing prevalence of irritable bowel syndrome (IBS) in Spain is a significant driver for the irritable bowel-syndrome-treatment market. Recent studies indicate that approximately 10-15% of the Spanish population experiences IBS symptoms, leading to a growing demand for effective treatment options. This rise in cases is attributed to various factors, including dietary changes and lifestyle stressors. As more individuals seek medical attention for their symptoms, healthcare providers are prompted to explore innovative treatment modalities. Consequently, pharmaceutical companies are investing in research and development to create targeted therapies, thereby expanding the irritable bowel-syndrome-treatment market. The heightened awareness of IBS among both patients and healthcare professionals further fuels this trend, as it encourages timely diagnosis and treatment, ultimately contributing to market growth.

Increased Healthcare Expenditure

Increased healthcare expenditure in Spain is a notable driver for the irritable bowel-syndrome-treatment market. The Spanish government has been investing more in healthcare services, which includes funding for gastrointestinal disorders. This financial commitment has led to improved access to diagnostic tools and treatment options for IBS patients. As healthcare budgets expand, there is a greater emphasis on providing comprehensive care, which encompasses both pharmacological and non-pharmacological treatments. This trend is likely to enhance patient outcomes and satisfaction, as individuals receive timely and effective interventions. Moreover, the rise in healthcare spending may encourage pharmaceutical companies to introduce new products and services, further stimulating the irritable bowel-syndrome-treatment market.

Advancements in Pharmaceutical Research

Advancements in pharmaceutical research play a crucial role in shaping the irritable bowel-syndrome-treatment market. The development of new medications, including novel classes of drugs such as guanylate cyclase-C agonists and serotonin receptor modulators, has provided patients with more effective treatment options. In Spain, the approval of these innovative therapies has led to increased accessibility for patients suffering from IBS. Furthermore, clinical trials are ongoing, with several promising candidates in the pipeline, which could potentially enhance treatment efficacy and patient outcomes. The investment in research not only addresses the unmet needs of patients but also stimulates competition among pharmaceutical companies, driving down costs and improving the overall landscape of the irritable bowel-syndrome-treatment market.

Growing Patient Advocacy and Support Groups

The emergence of patient advocacy and support groups is significantly influencing the irritable bowel-syndrome-treatment market. In Spain, these organizations are dedicated to raising awareness about IBS and providing resources for patients. They play a vital role in educating the public and healthcare professionals about the condition, which can lead to earlier diagnosis and treatment. Additionally, these groups often collaborate with healthcare providers and pharmaceutical companies to promote research initiatives and improve treatment options. The increased visibility of IBS through advocacy efforts encourages more individuals to seek help, thereby expanding the patient base for treatment providers. This trend not only enhances the overall understanding of IBS but also drives demand for innovative therapies within the irritable bowel-syndrome-treatment market.

Growing Demand for Non-Pharmacological Treatments

The growing demand for non-pharmacological treatments is emerging as a significant driver in the irritable bowel-syndrome-treatment market. Many patients in Spain are increasingly seeking alternative therapies, such as dietary modifications, probiotics, and psychological interventions, to manage their symptoms. This shift is partly due to concerns regarding the side effects of conventional medications and a desire for holistic approaches to health. As a result, healthcare providers are incorporating these non-pharmacological options into treatment plans, leading to a more comprehensive approach to IBS management. The rising interest in gut health and wellness further supports this trend, as patients become more informed about the benefits of lifestyle changes. Consequently, this demand is likely to influence the market dynamics and encourage the development of complementary treatment options.