Growth of Industry 4.0

The advent of Industry 4.0 is significantly influencing the iot integration market in Spain. This paradigm shift towards smart manufacturing and interconnected systems is prompting companies to adopt IoT solutions to remain competitive. The integration of IoT technologies enables real-time monitoring, predictive maintenance, and enhanced supply chain management. Recent studies suggest that the adoption of Industry 4.0 practices could increase productivity by up to 30% in manufacturing sectors. Consequently, the iot integration market is poised for substantial growth as businesses invest in advanced technologies to optimize their operations and drive innovation.

Emergence of 5G Technology

The rollout of 5G technology in Spain is set to revolutionize the iot integration market. With its high-speed connectivity and low latency, 5G enables seamless communication between IoT devices, facilitating the development of more sophisticated applications. Industries such as automotive, healthcare, and smart home technologies are likely to benefit immensely from this advancement. The Spanish telecommunications sector is investing heavily in 5G infrastructure, with projections indicating a market growth of 25% in IoT applications by 2027. This technological evolution is expected to enhance the capabilities of IoT systems, driving further integration and innovation within the market.

Increased Focus on Data Security

As the iot integration market expands in Spain, concerns regarding data security and privacy are becoming increasingly prominent. Businesses are recognizing the importance of safeguarding sensitive information transmitted through IoT devices. In response, there is a growing emphasis on implementing robust security protocols and compliance measures. The market for IoT security solutions is expected to grow by 20% annually, reflecting the urgent need for secure integration practices. This heightened focus on data protection is likely to drive innovation within the iot integration market, as companies seek to establish trust with consumers and ensure the integrity of their IoT ecosystems.

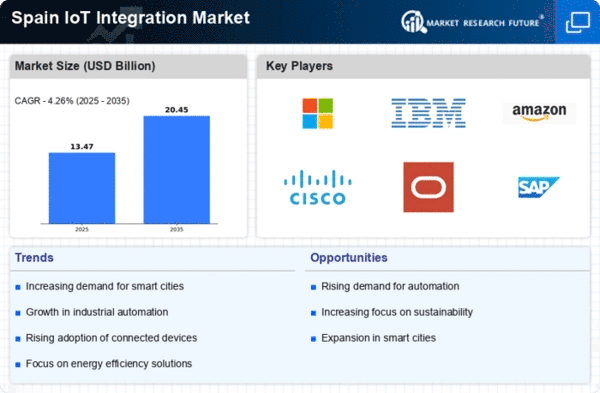

Expansion of Smart City Initiatives

Spain's commitment to developing smart cities is a pivotal driver for the iot integration market. Municipalities are investing heavily in IoT technologies to improve urban infrastructure, enhance public services, and promote sustainability. For instance, cities like Barcelona and Madrid are implementing smart lighting, waste management, and traffic monitoring systems, which rely on effective IoT integration. The Spanish government has allocated over €1 billion towards smart city projects, indicating a robust growth trajectory for the iot integration market. This investment not only fosters innovation but also enhances the quality of life for residents, making it a critical area of focus for future developments.

Rising Demand for Automation Solutions

The iot integration market in Spain experiences a notable surge in demand for automation solutions across various sectors. Industries such as manufacturing, logistics, and healthcare are increasingly adopting IoT technologies to enhance operational efficiency and reduce costs. According to recent data, the automation sector is projected to grow by approximately 15% annually, driven by the need for real-time data analytics and process optimization. This trend indicates a shift towards smart factories and connected supply chains, where IoT integration plays a crucial role. As businesses seek to streamline operations and improve productivity, the iot integration market is likely to benefit significantly from this growing demand for automation.