Aging Population in Spain

The demographic shift towards an aging population in Spain appears to be a primary driver for the Spain Intraocular Lens Market. As the population ages, the prevalence of age-related eye conditions, such as cataracts, increases significantly. According to recent statistics, approximately 30% of individuals over the age of 65 in Spain are affected by cataracts, necessitating surgical intervention and the implantation of intraocular lenses. This growing patient base is likely to propel the demand for intraocular lenses, as healthcare providers seek effective solutions to enhance vision quality. Furthermore, the Spanish government has been investing in healthcare infrastructure, which may facilitate access to cataract surgeries and, consequently, intraocular lens implantation. This trend suggests a robust market potential for intraocular lenses in Spain, driven by the needs of an aging demographic.

Growing Awareness and Education on Eye Health

Growing awareness and education regarding eye health in Spain are likely to drive the Spain Intraocular Lens Market. Public health campaigns and educational programs aimed at informing the population about the importance of regular eye check-ups and the risks associated with untreated cataracts are becoming more prevalent. These initiatives are fostering a culture of proactive health management, encouraging individuals to seek timely medical intervention. As awareness increases, more patients are likely to opt for cataract surgery and intraocular lens implantation, thereby expanding the market. Furthermore, collaborations between healthcare providers and community organizations to promote eye health education may enhance outreach efforts, particularly among at-risk populations. This heightened awareness could lead to a sustained increase in demand for intraocular lenses in Spain.

Government Initiatives and Healthcare Policies

Government initiatives and healthcare policies in Spain are likely to play a crucial role in shaping the Spain Intraocular Lens Market. The Spanish healthcare system, known for its universal coverage, has been actively promoting eye health awareness and preventive measures. Recent policies aimed at improving access to ophthalmic care, including cataract surgeries, have been implemented. For instance, the government has allocated additional funding to public hospitals for the procurement of advanced intraocular lenses. This funding is expected to enhance the availability of surgeries and improve patient outcomes. Moreover, public health campaigns focusing on the importance of regular eye examinations may lead to earlier detection of cataracts, thereby increasing the demand for intraocular lenses. Such initiatives suggest a supportive environment for market growth in the intraocular lens sector.

Technological Innovations in Lens Manufacturing

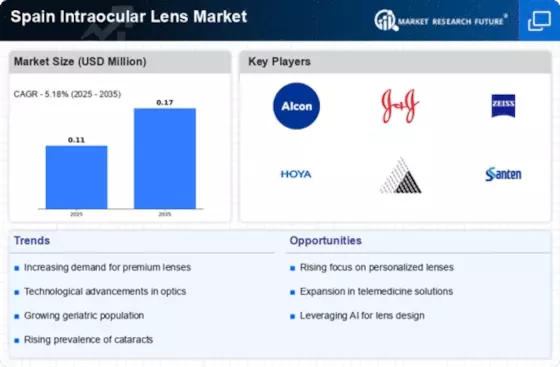

Technological advancements in lens manufacturing are poised to significantly influence the Spain Intraocular Lens Market. Innovations such as the development of multifocal and toric lenses have expanded the options available for patients undergoing cataract surgery. These advanced lenses are designed to address specific vision issues, such as astigmatism and presbyopia, thereby enhancing patient satisfaction and outcomes. The introduction of new materials and coatings has also improved the durability and performance of intraocular lenses. In Spain, the market for premium intraocular lenses has been growing, with a reported increase of 15% in sales over the past year. This growth indicates a shift in consumer preference towards high-quality lenses, which may further stimulate competition among manufacturers and drive innovation in the sector.

Rising Incidence of Diabetes and Related Eye Conditions

The rising incidence of diabetes in Spain is emerging as a significant driver for the Spain Intraocular Lens Market. Diabetes is known to contribute to various eye conditions, including diabetic retinopathy and cataracts. Recent data indicates that approximately 13% of the adult population in Spain is diagnosed with diabetes, a figure that is expected to rise in the coming years. This increase in diabetes prevalence is likely to correlate with a higher demand for intraocular lenses, as patients with diabetes may require cataract surgery at an earlier age. Additionally, healthcare providers are becoming more vigilant in monitoring eye health among diabetic patients, which may lead to increased referrals for lens implantation. Consequently, the intersection of diabetes and eye health presents a compelling opportunity for growth within the intraocular lens market.