Growing Aging Population

Spain's demographic shift towards an aging population is significantly impacting the interventional radiology-products market. By 2030, it is projected that over 25% of the Spanish population will be aged 65 and older. This demographic is more susceptible to various health issues, including vascular diseases and tumors, which often require interventional radiology procedures. The increasing number of elderly patients is likely to drive demand for innovative interventional radiology products that cater to their specific health needs. Furthermore, healthcare providers are expected to adapt their services to accommodate this demographic shift, potentially leading to a surge in the adoption of interventional radiology techniques.

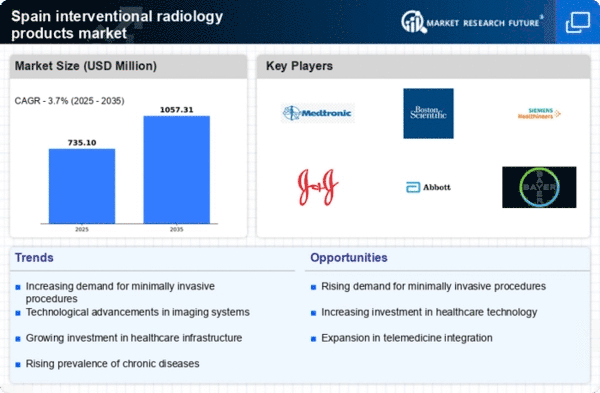

Advancements in Imaging Technologies

The continuous evolution of imaging technologies is a pivotal factor influencing the interventional radiology-products market. Innovations such as 3D imaging, MRI, and CT scans enhance the precision and effectiveness of interventional procedures. In Spain, the integration of these advanced imaging modalities into clinical practice is expected to improve diagnostic accuracy and treatment outcomes. As healthcare facilities invest in state-of-the-art imaging technologies, the demand for complementary interventional radiology products is likely to increase. This synergy between imaging advancements and interventional techniques may lead to more efficient procedures, ultimately benefiting patient care and driving market growth.

Healthcare Infrastructure Development

The ongoing development of healthcare infrastructure in Spain is a critical driver for the interventional radiology products market. Investments in modernizing hospitals and clinics are enhancing the capacity to perform advanced interventional procedures. The Spanish government has allocated substantial funding towards upgrading healthcare facilities, which is expected to facilitate the adoption of cutting-edge interventional radiology technologies. Improved infrastructure not only supports the implementation of these products but also enhances patient access to necessary treatments. As healthcare facilities evolve, the interventional radiology-products market is likely to experience growth, driven by the increased availability of advanced medical technologies.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in Spain is a crucial driver for the interventional radiology-products market. Conditions such as cardiovascular diseases, cancer, and diabetes are becoming more prevalent, necessitating advanced treatment options. According to recent health statistics, chronic diseases account for approximately 70% of all deaths in Spain, highlighting the urgent need for effective medical interventions. This trend is likely to propel the demand for interventional radiology products, as they offer minimally invasive solutions that can improve patient outcomes. The healthcare system's focus on managing these diseases effectively is expected to lead to increased investments in interventional radiology technologies, thereby expanding the market.

Rising Awareness and Acceptance of Interventional Procedures

There is a notable increase in public awareness and acceptance of interventional procedures in Spain, which serves as a significant driver for the interventional radiology-products market. Educational campaigns and improved access to information have empowered patients to seek out minimally invasive treatment options. As a result, more individuals are opting for interventional radiology procedures over traditional surgical methods. This shift in patient preference is likely to stimulate demand for interventional radiology products, as healthcare providers respond to the growing interest in these innovative solutions. The trend suggests a promising future for the market as awareness continues to expand.