Rise of Podcasting

The growing popularity of podcasts in Spain appears to be a significant driver for the internet radio market. As of 2025, approximately 40% of the Spanish population engages with podcast content regularly. This trend indicates a shift in audio consumption habits, where listeners are seeking more diverse and niche content. Internet radio platforms are increasingly incorporating podcasts into their offerings, which may attract a broader audience. The integration of podcasts allows users to access a variety of topics, from news to entertainment, all in one place. This diversification of content could potentially enhance the appeal of internet radio services, making them more attractive to advertisers looking to reach specific demographics. Consequently, the internet radio market may experience growth as it adapts to these changing consumer preferences.

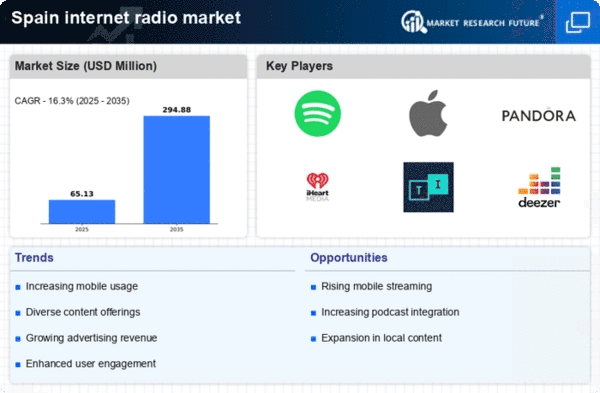

Growing Mobile Usage

The increasing penetration of smartphones in Spain appears to be a pivotal driver for the internet radio market. As of 2025, mobile devices account for approximately 80% of all internet traffic in the country. This trend suggests that consumers are increasingly accessing audio content on-the-go, leading to a surge in demand for internet radio services. The convenience of mobile applications allows users to listen to their favorite stations anytime and anywhere, which may enhance user engagement. Furthermore, the rise of mobile data plans with unlimited access could potentially encourage more listeners to explore various internet radio channels. This shift in consumer behavior indicates a promising growth trajectory for the internet radio market, as it aligns with the lifestyle of a tech-savvy population that values flexibility and accessibility.

Enhanced User Experience

The internet radio market in Spain is likely benefiting from advancements in user interface design and personalization features. Streaming platforms are increasingly focusing on creating intuitive interfaces that enhance user engagement. Features such as personalized playlists, algorithm-driven recommendations, and interactive content are becoming standard. This focus on user experience may lead to higher listener retention rates, as users are more inclined to return to platforms that cater to their preferences. Moreover, the integration of social media sharing options allows users to connect with friends and share their favorite stations, further promoting the internet radio market. As competition intensifies, companies that prioritize user experience may gain a competitive edge, potentially leading to increased market share and revenue.

Increased Advertising Revenue

The internet radio market in Spain is likely experiencing a surge in advertising revenue, driven by the effectiveness of targeted advertising strategies. Advertisers are increasingly recognizing the value of reaching specific audiences through internet radio platforms. As of 2025, the market is projected to generate over €100 million in advertising revenue, reflecting a growing trend towards digital marketing. This increase may be attributed to the ability of internet radio to provide detailed listener analytics, allowing advertisers to tailor their campaigns more effectively. Furthermore, the rise of programmatic advertising in the internet radio market enables real-time ad placements, enhancing the efficiency of marketing efforts. This shift towards data-driven advertising strategies could potentially lead to a more lucrative environment for internet radio services, fostering further investment and innovation.

Expansion of Internet Infrastructure

The ongoing expansion of internet infrastructure in Spain appears to be a crucial driver for the internet radio market. With the rollout of high-speed broadband and 5G networks, more consumers are gaining access to reliable internet services. As of 2025, approximately 90% of households in urban areas have access to high-speed internet, which may facilitate the growth of streaming services. This improved connectivity allows for seamless streaming of audio content, enhancing the overall user experience. Additionally, rural areas are also witnessing improvements in internet access, which could potentially broaden the listener base for internet radio. As more individuals gain access to high-quality internet services, the internet radio market may continue to expand, catering to a diverse audience across various regions.