Increased Focus on Preventive Healthcare

The herbal medicinal-products market in Spain is benefiting from a heightened focus on preventive healthcare. As individuals become more proactive about their health, there is a growing interest in herbal products that promote wellness and prevent illness. This trend is reflected in the rising sales of herbal supplements and tonics, which have seen an increase of approximately 25% in recent years. Consumers are increasingly turning to herbal solutions for immune support, stress relief, and overall vitality. This shift towards preventive measures is likely to drive innovation within the market, as companies develop new formulations that cater to these health-conscious consumers. The emphasis on preventive healthcare may also lead to greater collaboration between herbal product manufacturers and healthcare professionals, further legitimizing the use of herbal remedies.

Cultural Heritage and Traditional Practices

Spain's rich cultural heritage and traditional practices play a crucial role in shaping the herbal medicinal-products market. Many consumers are drawn to herbal remedies that have been used for generations, reflecting a deep-rooted appreciation for traditional knowledge. This cultural connection not only influences consumer preferences but also encourages the preservation of indigenous plant species and traditional preparation methods. Recent studies suggest that approximately 20% of the population actively seeks out herbal products that are rooted in local traditions. This trend presents an opportunity for market players to highlight the authenticity and historical significance of their products, potentially attracting consumers who value heritage and authenticity. As a result, the herbal medicinal-products market may see a rise in products that celebrate Spain's botanical diversity and traditional healing practices.

Expansion of E-commerce and Digital Marketing

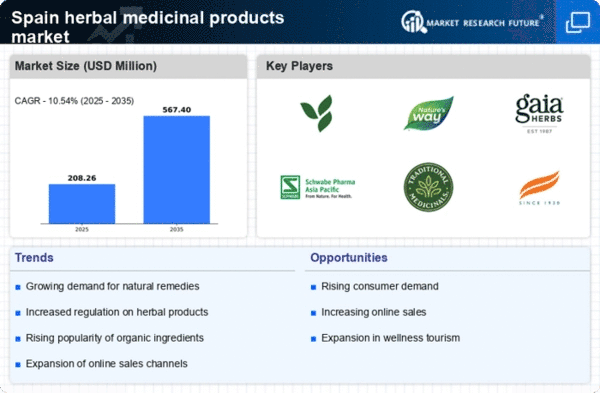

The herbal medicinal-products market is witnessing a transformation due to the expansion of e-commerce and digital marketing strategies. With the rise of online shopping, consumers in Spain are increasingly turning to digital platforms to purchase herbal products. Recent statistics indicate that online sales of herbal remedies have surged by over 35% in the past year, highlighting a shift in consumer behavior. This trend presents a significant opportunity for businesses to reach a broader audience and enhance brand visibility. Moreover, effective digital marketing campaigns can educate consumers about the benefits of herbal products, thereby fostering trust and encouraging purchases. As e-commerce continues to grow, the herbal medicinal-products market is likely to see increased competition and innovation in online retail strategies.

Growing Demand for Alternative Health Solutions

The herbal medicinal-products market in Spain is experiencing a notable increase in demand as consumers seek alternative health solutions. This shift is largely driven by a growing awareness of the potential side effects associated with synthetic pharmaceuticals. According to recent data, approximately 30% of the Spanish population has expressed a preference for natural remedies over conventional medications. This trend indicates a significant opportunity for the herbal medicinal-products market to expand its offerings and cater to health-conscious consumers. Furthermore, the increasing prevalence of chronic diseases has prompted individuals to explore herbal options as complementary therapies. As a result, the market is likely to witness a surge in product innovation, focusing on efficacy and safety, thereby enhancing consumer trust in herbal remedies.

Rising Interest in Sustainable and Organic Products

Sustainability has become a pivotal concern for consumers in Spain, influencing their purchasing decisions in the herbal medicinal-products market. A growing segment of the population is prioritizing organic and sustainably sourced products, reflecting a broader trend towards environmental consciousness. Recent surveys indicate that over 40% of consumers are willing to pay a premium for organic herbal products, which suggests a lucrative market opportunity. This inclination towards sustainability not only aligns with consumer values but also encourages manufacturers to adopt eco-friendly practices in sourcing and production. Consequently, the herbal medicinal-products market is likely to see an increase in the availability of certified organic options, appealing to environmentally aware consumers and potentially driving market growth.