Patient Privacy Concerns

Patient privacy remains a paramount concern within the healthcare iot-security market in Spain. With the implementation of stringent data protection regulations, such as the General Data Protection Regulation (GDPR), healthcare providers are compelled to prioritize the security of personal health information. Non-compliance can result in hefty fines, which may reach up to €20 million or 4% of annual global turnover, whichever is higher. This regulatory landscape drives healthcare organizations to invest in comprehensive security measures to ensure compliance and protect patient data. As awareness of privacy issues grows, the The market is likely to see increased demand. for solutions that address these challenges.

Integration of IoT Devices

The proliferation of Internet of Things (IoT) devices within the healthcare sector is a significant driver for the healthcare iot-security market in Spain. As hospitals and clinics increasingly adopt smart devices for patient monitoring and management, the potential for data breaches escalates. A recent study suggests that over 70% of healthcare organizations in Spain plan to expand their IoT device usage in the next few years. This expansion necessitates enhanced security protocols to safeguard against unauthorized access and data leaks. Consequently, the demand for advanced security solutions tailored to IoT environments is likely to rise, fostering growth in the healthcare iot-security market.

Rising Cybersecurity Threats

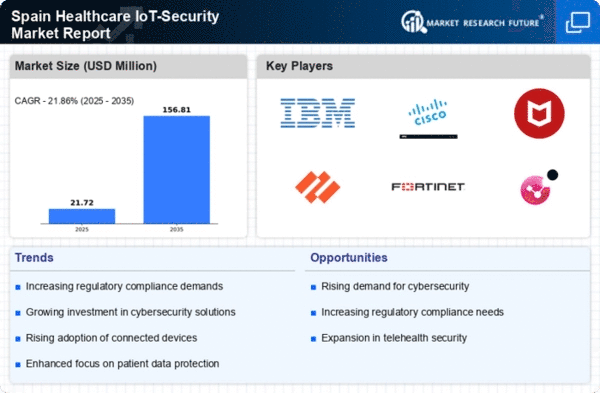

The healthcare iot-security market in Spain is experiencing heightened concern due to the increasing frequency and sophistication of cyberattacks targeting healthcare systems. With the rise of connected medical devices, vulnerabilities have become more pronounced, leading to potential breaches of sensitive patient data. Reports indicate that healthcare organizations in Spain have faced a surge in ransomware attacks, prompting a reevaluation of security measures. As a result, investments in cybersecurity solutions are projected to grow, with the market expected to reach €1 billion by 2026. This trend underscores the urgent need for robust security frameworks to protect patient information and maintain trust in healthcare services.

Technological Advancements in Security Solutions

The healthcare iot-security market in Spain is being propelled by rapid advancements in security technologies. Innovations such as artificial intelligence (AI) and machine learning (ML) are being integrated into security frameworks, enhancing the ability to detect and respond to threats in real-time. These technologies can analyze vast amounts of data to identify anomalies and potential breaches, thereby improving overall security posture. As healthcare organizations seek to adopt these cutting-edge solutions, the market for healthcare iot-security is expected to expand significantly. Analysts predict that by 2027, the market could grow by over 30%, driven by the need for more sophisticated security measures.

Increased Investment in Healthcare Infrastructure

The ongoing investment in healthcare infrastructure in Spain is a crucial driver for the healthcare iot-security market. As the government and private sector allocate funds to modernize healthcare facilities, the integration of IoT devices becomes more prevalent. This modernization effort aims to improve patient care and operational efficiency but also raises security concerns. With an estimated €2 billion earmarked for healthcare technology upgrades in the coming years, the demand for security solutions that can protect these investments is likely to rise. Consequently, the healthcare iot-security market is positioned for growth as organizations seek to secure their enhanced technological capabilities.