Rising Cyber Threats

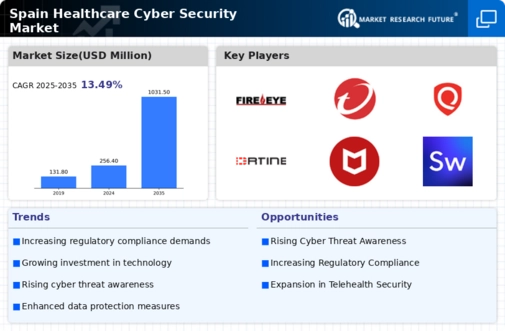

Spain's healthcare cyber-security market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. Recent reports indicate that healthcare organizations are prime targets for cybercriminals, with ransomware attacks rising by over 30% in the last year alone. This alarming trend compels healthcare providers to invest in robust cyber-security measures to protect sensitive patient data and maintain operational integrity. the potential financial repercussions of a data breach, which can exceed € 2 million, further underscore the urgency for enhanced security protocols. As a result, The healthcare cyber-security market is likely to see substantial growth as organizations prioritize safeguarding digital assets against evolving threats.

Integration of IoT Devices

The integration of Internet of Things (IoT) devices within healthcare settings in Spain is reshaping the landscape of the healthcare cyber-security market. As hospitals and clinics increasingly adopt connected medical devices, the potential for cyber vulnerabilities rises. These devices, while enhancing patient care, can also serve as entry points for cyber-attacks if not adequately secured. Reports suggest that nearly 60% of healthcare organizations in Spain are expected to deploy IoT solutions by 2026. This trend necessitates a corresponding increase in cyber-security measures to protect against potential threats, thereby driving demand for specialized security solutions in the healthcare cyber-security market.

Growing Patient Data Volume

The exponential increase in patient data generated by healthcare providers in Spain is a critical driver for the healthcare cyber-security market. With the rise of electronic health records (EHRs) and telemedicine, healthcare organizations are managing vast amounts of sensitive information. This surge in data volume necessitates the implementation of advanced cyber-security solutions to prevent unauthorized access and data breaches. According to estimates, the healthcare sector could see a 25% increase in data generation over the next five years. As healthcare providers strive to protect this valuable information, investments in cyber-security technologies are likely to escalate, further propelling market growth.

Government Initiatives and Funding

In Spain, government initiatives aimed at bolstering cyber-security in the healthcare sector are significantly influencing the healthcare cyber-security market. The Spanish government has allocated approximately €100 million to enhance cyber-security infrastructure across public health institutions. This funding is intended to support the implementation of advanced security technologies and training programs for healthcare professionals. Such initiatives not only promote compliance with regulatory standards but also foster a culture of security awareness within healthcare organizations. Consequently, The influx of government support is expected to drive market growth as healthcare providers align with national cyber-security strategies to protect against potential vulnerabilities.

Increased Awareness of Cyber Risks

There is a growing awareness of cyber risks among healthcare organizations in Spain, which is significantly impacting the healthcare cyber-security market. As high-profile data breaches make headlines, healthcare providers are becoming more cognizant of the potential consequences of inadequate cyber-security measures. This heightened awareness is prompting organizations to prioritize investments in security technologies and training programs. Surveys indicate that over 70% of healthcare executives now consider cyber-security a top priority. This shift in mindset is likely to lead to increased spending on cyber-security solutions, thereby fostering growth in the healthcare cyber-security market as organizations seek to mitigate risks and protect patient information.