Surge in Elderly Population

The demographic shift towards an aging population in Spain is creating a pressing need for surgical interventions, thereby influencing the handheld surgical-devices market. As the elderly population continues to grow, the prevalence of age-related health issues, such as cardiovascular diseases and orthopedic conditions, is expected to rise. This demographic trend suggests that there will be an increased demand for surgical procedures, which in turn drives the need for efficient and effective handheld surgical devices. It is estimated that by 2030, the elderly population will constitute over 25% of Spain's total population, further emphasizing the importance of this market segment.

Focus on Patient-Centric Care

The shift towards patient-centric care in Spain is reshaping the handheld surgical-devices market. Healthcare providers are increasingly prioritizing patient comfort and satisfaction, leading to a demand for devices that minimize invasiveness and enhance the overall surgical experience. This focus on patient-centric approaches is likely to drive innovation in handheld surgical devices, as manufacturers strive to develop tools that align with these evolving healthcare paradigms. The market is expected to see a rise in the adoption of devices that facilitate quicker recovery times and reduced hospital stays, reflecting the growing emphasis on patient outcomes and satisfaction.

Rising Demand for Precision Surgery

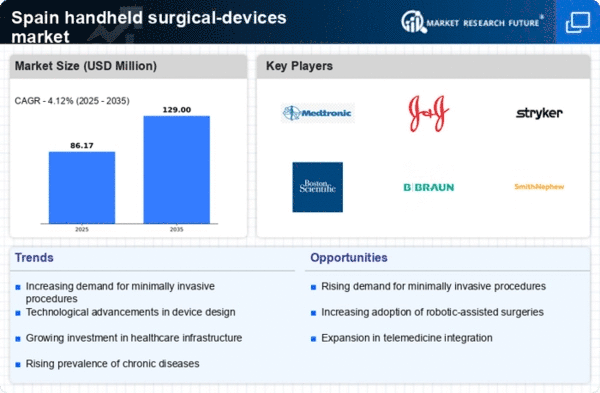

The handheld surgical-devices market in Spain is experiencing a notable increase in demand for precision surgical instruments. Surgeons and healthcare professionals are increasingly favoring devices that offer enhanced accuracy and control during procedures. This trend is driven by the growing awareness of the benefits of precision surgery, which can lead to improved patient outcomes and reduced recovery times. According to recent data, the market for precision surgical instruments is projected to grow at a CAGR of 8% over the next five years. This rising demand is likely to propel the handheld surgical-devices market, as manufacturers innovate to meet the needs of healthcare providers seeking advanced solutions.

Technological Integration in Surgical Procedures

The integration of advanced technologies, such as robotics and artificial intelligence, into surgical procedures is significantly influencing the handheld surgical-devices market in Spain. Surgeons are increasingly utilizing these technologies to enhance their capabilities and improve surgical precision. The incorporation of smart handheld devices that provide real-time data and analytics is becoming more prevalent, suggesting a transformative shift in surgical practices. This trend is expected to drive the handheld surgical-devices market as healthcare providers seek to leverage technology to improve surgical outcomes and operational efficiency.

Increased Investment in Healthcare Infrastructure

Spain's commitment to enhancing its healthcare infrastructure is significantly impacting the handheld surgical-devices market. The government has allocated substantial funding to modernize hospitals and surgical centers, which includes the procurement of advanced surgical devices. This investment is expected to reach approximately €1 billion by 2026, facilitating the adoption of state-of-the-art handheld surgical devices. As healthcare facilities upgrade their equipment, the demand for innovative surgical tools is likely to rise, thereby driving growth in the handheld surgical-devices market. This trend reflects a broader commitment to improving healthcare delivery and patient care across the nation.