Regulatory Support and Frameworks

Regulatory support plays a crucial role in shaping the genomics market in Spain. The government has established frameworks that promote research and development in genomics, ensuring compliance with ethical standards while facilitating innovation. Initiatives aimed at streamlining the approval process for genomic technologies are likely to encourage more companies to enter the market. Furthermore, the Spanish government has allocated funding to support genomics research, which is expected to enhance the overall landscape of the genomics market. By 2025, the regulatory environment is anticipated to become more favorable, potentially leading to a 15% increase in new product launches and services within the sector.

Advancements in Genomic Technologies

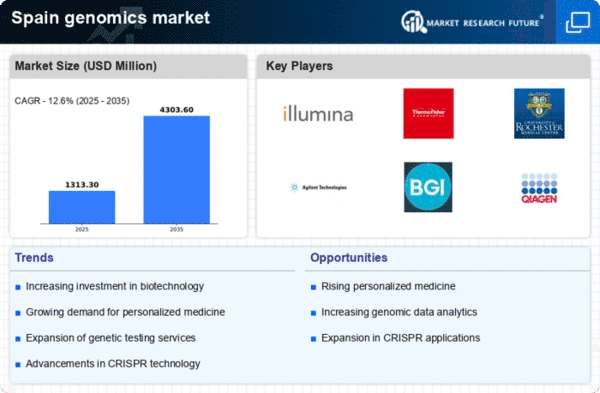

The genomics market in Spain is experiencing a surge due to rapid advancements in genomic technologies. Innovations such as next-generation sequencing (NGS) and CRISPR gene editing are revolutionizing the field, enabling more precise and efficient genetic analysis. These technologies are not only enhancing research capabilities but also facilitating the development of personalized medicine. In 2025, the market is projected to reach approximately €1.5 billion, reflecting a growth rate of around 12% annually. This growth is driven by increased accessibility to genomic tools and a growing number of research institutions adopting these technologies. As a result, the genomics market is likely to expand significantly, attracting investments and fostering collaborations among academic and commercial entities.

Rising Public Awareness and Education

Public awareness regarding the benefits of genomics is steadily increasing in Spain, contributing to the growth of the genomics market. Educational campaigns and outreach programs are effectively informing the population about genetic testing and personalized medicine. This heightened awareness is likely to drive demand for genomic services, as individuals seek to understand their genetic predispositions and health risks. By 2025, it is estimated that the number of genetic tests conducted in Spain could rise by 20%, reflecting a growing consumer interest in genomics. Consequently, this trend is expected to stimulate market growth, as healthcare providers and laboratories expand their offerings to meet the rising demand.

Collaborations Between Academia and Industry

Collaborative efforts between academic institutions and industry players are becoming increasingly prevalent in the genomics market in Spain. These partnerships are fostering innovation and accelerating the translation of research findings into practical applications. By pooling resources and expertise, stakeholders are likely to enhance the development of new genomic technologies and therapies. In 2025, it is projected that such collaborations could lead to a 10% increase in research output and commercialization of genomic products. This synergy not only benefits the involved parties but also contributes to the overall advancement of the genomics market, positioning Spain as a key player in the European landscape.

Integration of Genomics in Healthcare Systems

The integration of genomics into healthcare systems is a pivotal driver for the genomics market in Spain. As healthcare providers increasingly recognize the value of genomic information in clinical decision-making, the demand for genomic services is expected to rise. This integration is likely to enhance patient outcomes through personalized treatment plans and targeted therapies. By 2025, it is anticipated that the adoption of genomic data in clinical settings could increase by 25%, reflecting a growing trend towards precision medicine. This shift is expected to not only improve healthcare delivery but also stimulate growth within the genomics market, as more healthcare institutions invest in genomic capabilities.