Rising Demand for Automation

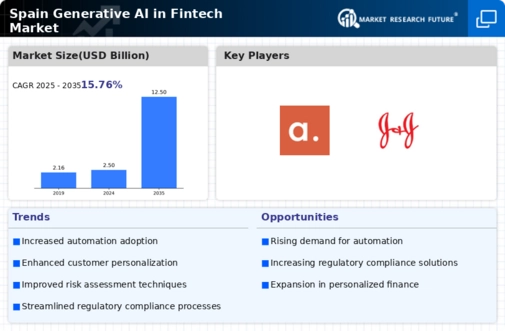

The Spain generative ai fintech market is experiencing a notable surge in demand for automation solutions. Financial institutions are increasingly adopting generative AI technologies to streamline operations, enhance customer service, and reduce costs. According to recent data, over 60 percent of Spanish banks are investing in AI-driven automation tools, which suggests a strong inclination towards efficiency. This trend is likely to continue as firms seek to optimize their processes and improve service delivery. The integration of generative AI allows for the automation of routine tasks, enabling financial professionals to focus on more complex issues. As a result, the Spain generative ai fintech market is poised for growth, driven by the need for operational efficiency and improved customer experiences.

Regulatory Support for Innovation

The Spain generative ai fintech market benefits from a regulatory environment that supports innovation. The Spanish government has implemented policies aimed at fostering technological advancements in the financial sector. Initiatives such as the Fintech Law, which encourages the development of new technologies, have created a conducive atmosphere for generative AI applications. This regulatory backing is crucial as it provides a framework for companies to operate while ensuring consumer protection. As a result, the Spain generative ai fintech market is likely to see increased investment and innovation, as firms feel more secure in their ability to navigate the regulatory landscape. This supportive environment may attract both domestic and international players to the market.

Enhanced Data Analytics Capabilities

In the Spain generative ai fintech market, enhanced data analytics capabilities are becoming increasingly vital. Financial institutions are leveraging generative AI to analyze vast amounts of data, providing insights that were previously unattainable. This capability allows for better risk assessment, fraud detection, and personalized financial advice. Recent statistics indicate that firms utilizing AI-driven analytics have seen a 30 percent improvement in decision-making speed. As the demand for data-driven insights grows, the Spain generative ai fintech market is likely to expand, with companies investing in advanced analytics tools to stay competitive. The ability to harness data effectively is essential for firms aiming to meet the evolving needs of their customers.

Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the Spain generative ai fintech market. Financial institutions and tech companies are increasingly allocating resources to R&D to explore new applications of generative AI. This focus on innovation is essential for staying competitive in a rapidly evolving market. Recent reports suggest that R&D spending in the fintech sector has increased by 25 percent in Spain over the past year. Such investments are likely to lead to the development of cutting-edge solutions that address emerging challenges in the financial landscape. As firms continue to innovate, the Spain generative ai fintech market is expected to expand, driven by advancements in technology and the pursuit of excellence in financial services.

Growing Consumer Acceptance of AI Solutions

Consumer acceptance of AI solutions is a significant driver in the Spain generative ai fintech market. As individuals become more familiar with AI technologies, their willingness to engage with AI-driven financial services increases. Surveys indicate that approximately 70 percent of Spanish consumers are open to using AI for personal finance management. This growing acceptance is likely to encourage financial institutions to invest in generative AI solutions that cater to consumer preferences. The ability to provide personalized services through AI can enhance customer satisfaction and loyalty. Consequently, the Spain generative ai fintech market is expected to thrive as firms capitalize on this trend, developing innovative products that resonate with tech-savvy consumers.