Emergence of IoT and Smart Technologies

The proliferation of Internet of Things (IoT) devices is reshaping the FPGA in Telecom Sector market. As Spain embraces smart technologies, the demand for efficient data processing and real-time analytics is surging. FPGAs are well-suited for handling the massive data streams generated by IoT devices, enabling telecom operators to offer innovative services. The IoT market in Spain is projected to reach €10 billion by 2025, creating substantial opportunities for FPGA integration. This trend suggests that the growth of IoT will be a significant driver for the fpga in-telecom-sector market, as operators seek to leverage FPGA capabilities to enhance service offerings.

Advancements in Telecommunications Technology

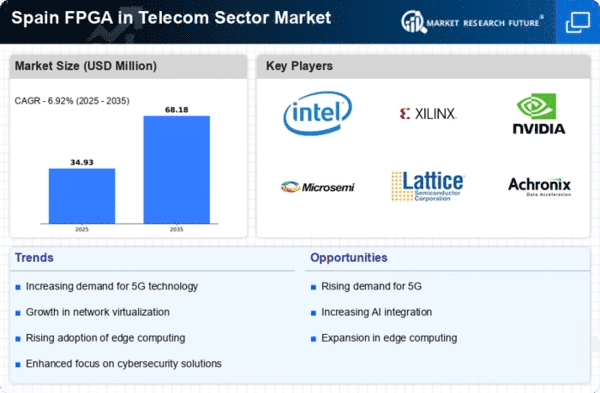

The rapid evolution of telecommunications technology is a primary driver for the FPGA in Telecom Sector market. Innovations such as 5G and beyond are necessitating the deployment of advanced hardware solutions. FPGAs offer the flexibility and performance required to support high-speed data transmission and low-latency applications. In Spain, the telecommunications sector is projected to invest approximately €3 billion in infrastructure upgrades by 2026, with a significant portion allocated to FPGA-based solutions. This investment is likely to enhance network capabilities and improve service delivery, thereby driving demand for FPGAs in the telecom sector.

Growing Demand for Enhanced Security Solutions

Security concerns are driving the need for advanced solutions in the fpga in-telecom-sector market. With the increasing frequency of cyber threats, telecom operators in Spain are prioritizing the implementation of robust security measures. FPGAs can be programmed to execute complex encryption algorithms, providing a layer of security that is essential for protecting sensitive data. The Spanish government has allocated €500 million towards enhancing cybersecurity in telecommunications, which is likely to boost the adoption of FPGA technology. This focus on security is expected to significantly influence the market dynamics in the coming years.

Increased Focus on Customization and Scalability

Customization and scalability are becoming increasingly vital in the fpga in-telecom-sector market. As telecom operators in Spain seek to differentiate their services, the ability to tailor solutions to specific needs is paramount. FPGAs provide a unique advantage due to their reconfigurable nature, allowing operators to adapt to changing market demands swiftly. The market for FPGAs in telecommunications is expected to grow at a CAGR of 12% through 2027, reflecting the rising need for scalable solutions. This trend indicates a shift towards more personalized telecom services, further propelling the adoption of FPGAs.

Regulatory Support for Telecommunications Innovation

Regulatory frameworks in Spain are increasingly supportive of innovation within the telecommunications sector, acting as a catalyst for the fpga in-telecom-sector market. The government has introduced policies aimed at fostering technological advancements and encouraging investment in next-generation networks. These initiatives are likely to create a conducive environment for FPGA adoption, as operators seek to comply with new regulations while enhancing their service capabilities. The Spanish telecommunications market is expected to see an influx of €1 billion in investments due to these supportive measures, further driving the demand for FPGA solutions.