Growth in Academic Research

The academic research landscape in Spain is evolving, with increased funding and emphasis on scientific innovation. This trend is likely to bolster the flash chromatography market, as researchers require advanced separation techniques for various applications, including organic chemistry and biochemistry. In 2025, public and private investment in research and development is anticipated to reach €15 billion, reflecting a commitment to fostering scientific advancements. Consequently, the demand for flash chromatography systems is expected to rise, as academic institutions seek to equip their laboratories with cutting-edge technology. This growth in research activities may lead to a greater adoption of flash chromatography, enhancing its presence in the academic sector.

Rising Demand in Pharmaceutical Sector

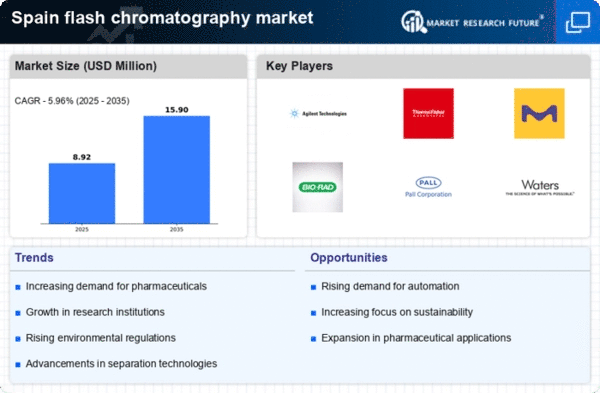

The pharmaceutical sector in Spain is experiencing a notable increase in demand for efficient separation techniques, which is likely to drive the flash chromatography market. As the industry focuses on drug development and quality control, the need for rapid and effective purification methods becomes paramount. Flash chromatography offers a solution that aligns with these requirements, enabling faster processing times and improved yield. In 2024, the pharmaceutical industry in Spain was valued at approximately €30 billion, and it is projected to grow at a CAGR of 5% through 2028. This growth is expected to further stimulate the flash chromatography market, as companies seek to enhance their analytical capabilities and streamline production processes.

Technological Integration and Automation

the integration of advanced technologies and automation in laboratory processes was likely to influence the flash chromatography market in Spain. As laboratories strive for efficiency and reproducibility, the adoption of automated flash chromatography systems is becoming more prevalent. These systems not only enhance throughput but also reduce human error, aligning with the industry's push for precision. In 2025, the market for laboratory automation in Spain is expected to exceed €1 billion, reflecting a growing trend towards automated solutions. This shift may drive the flash chromatography market, as laboratories seek to modernize their operations and improve analytical capabilities through technological advancements.

Regulatory Compliance and Quality Assurance

In Spain, stringent regulatory frameworks governing the pharmaceutical and food industries necessitate rigorous quality assurance measures. This regulatory environment is likely to propel the flash chromatography market, as companies seek reliable methods for ensuring compliance with safety and quality standards. Flash chromatography provides a rapid and efficient means of analyzing complex mixtures, making it an attractive option for industries facing regulatory scrutiny. The market for analytical instruments in Spain was valued at approximately €1.2 billion in 2024, with a significant portion attributed to compliance-driven technologies. As regulations continue to evolve, the demand for flash chromatography solutions is expected to grow, driven by the need for enhanced quality control.

Emerging Applications in Environmental Testing

The flash chromatography market is poised for growth in Spain due to its emerging applications in environmental testing. As environmental concerns gain prominence, industries are increasingly required to monitor pollutants and contaminants in various matrices. Flash chromatography offers a rapid and efficient method for analyzing environmental samples, making it a valuable tool for laboratories engaged in environmental monitoring. The Spanish government has committed to reducing pollution levels, which may lead to increased funding for environmental research and testing. In 2025, the environmental testing market in Spain is projected to reach €500 million, indicating a potential surge in demand for flash chromatography systems to support these initiatives.