Growing Pharmaceutical Sector

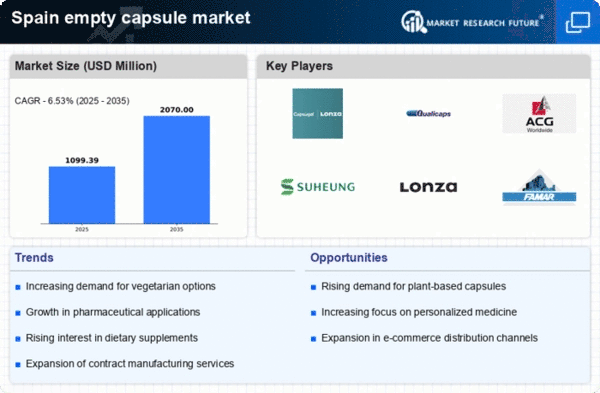

The pharmaceutical sector in Spain is experiencing notable growth, which appears to be a significant driver for the empty capsule market. With an increasing number of pharmaceutical companies establishing operations in the country, the demand for empty capsules is likely to rise. In 2025, the pharmaceutical market in Spain is projected to reach approximately €30 billion, indicating a robust environment for the empty capsule market. This growth is attributed to the rising prevalence of chronic diseases and the need for innovative drug delivery systems. As pharmaceutical companies seek to enhance their product offerings, the demand for high-quality empty capsules is expected to increase, thereby propelling the empty capsule market forward.

Rising Popularity of Dietary Supplements

The dietary supplement market in Spain is witnessing a surge in popularity, which seems to be a key driver for the empty capsule market. As consumers become more health-conscious, the demand for dietary supplements is expected to grow. In 2025, the dietary supplement market in Spain is projected to reach €2 billion, reflecting a growing trend towards preventive healthcare. Empty capsules are increasingly favored for encapsulating various herbal and nutritional products, as they offer a convenient and effective delivery method. This trend indicates that the empty capsule market is likely to benefit from the expanding dietary supplement sector, as manufacturers seek to meet consumer demands for high-quality, easy-to-consume products.

Regulatory Support for Innovative Drug Delivery

Regulatory frameworks in Spain are increasingly supportive of innovative drug delivery systems, which may positively impact the empty capsule market. The Spanish Agency of Medicines and Medical Devices (AEMPS) has been actively promoting the development of advanced pharmaceutical formulations. This regulatory support encourages pharmaceutical companies to explore new delivery methods, including the use of empty capsules. As a result, the empty capsule market could witness a surge in demand as companies seek to comply with evolving regulations and meet consumer expectations for effective drug delivery. The emphasis on safety and efficacy in drug development further underscores the importance of high-quality empty capsules in the pharmaceutical landscape.

Technological Innovations in Capsule Production

Technological innovations in capsule production are playing a crucial role in shaping the empty capsule market in Spain. Advances in manufacturing processes, such as the development of non-gelatin capsules and improvements in encapsulation techniques, are enhancing the quality and efficiency of capsule production. These innovations are likely to attract more manufacturers to the empty capsule market, as they seek to offer diverse product options to consumers. Furthermore, the integration of automation and digital technologies in production lines may lead to cost reductions and increased output, thereby fostering growth in the empty capsule market. As companies adapt to these technological advancements, the market is expected to evolve, offering new opportunities for stakeholders.

Consumer Preference for Vegan and Vegetarian Products

The growing consumer preference for vegan and vegetarian products is emerging as a significant driver for the empty capsule market in Spain. As more individuals adopt plant-based diets, the demand for vegan capsules is likely to increase. This shift in consumer behavior is prompting manufacturers to develop empty capsules made from plant-derived materials, catering to the needs of health-conscious consumers. In 2025, the market for vegan capsules in Spain is anticipated to grow by approximately 15%, reflecting the rising trend towards sustainable and ethical consumption. Consequently, the empty capsule market is expected to adapt to these changing preferences, leading to the introduction of innovative products that align with consumer values.