Advancements in Communication Systems

The digital railway market in Spain is experiencing a notable transformation due to advancements in communication systems. Enhanced connectivity through technologies such as 5G and IoT is facilitating real-time data exchange between trains and control centers. This improvement is expected to increase operational efficiency and safety, potentially reducing delays by up to 30%. Furthermore, the integration of these systems allows for better monitoring of train conditions, which is crucial for predictive maintenance. As a result, the digital railway market is likely to see a surge in investments, with projections indicating a growth rate of approximately 15% annually over the next five years. This trend underscores the importance of robust communication infrastructure in modernizing rail operations.

Growing Demand for Passenger Experience

In Spain, the digital railway market is increasingly driven by the growing demand for enhanced passenger experience. Travelers are seeking more comfort, convenience, and connectivity during their journeys. The implementation of digital solutions such as mobile ticketing, onboard Wi-Fi, and real-time travel updates is becoming essential. According to recent surveys, over 70% of passengers express a preference for trains equipped with advanced digital features. This shift in consumer expectations is prompting railway operators to invest in technology that improves service quality. Consequently, the digital railway market is projected to expand significantly, with an estimated market value reaching €5 billion by 2027. This focus on passenger satisfaction is reshaping the competitive landscape of the industry.

Emergence of Data Analytics in Operations

The emergence of data analytics is significantly influencing the digital railway market in Spain. Railway operators are increasingly leveraging big data to optimize operations and improve decision-making processes. By analyzing passenger flow, maintenance needs, and operational efficiency, companies can enhance service delivery and reduce costs. For instance, predictive analytics can identify potential disruptions before they occur, allowing for proactive measures. This capability is expected to lead to a reduction in operational costs by approximately 15%. As data-driven strategies become more prevalent, the digital railway market is likely to witness a paradigm shift, with analytics playing a central role in operational excellence.

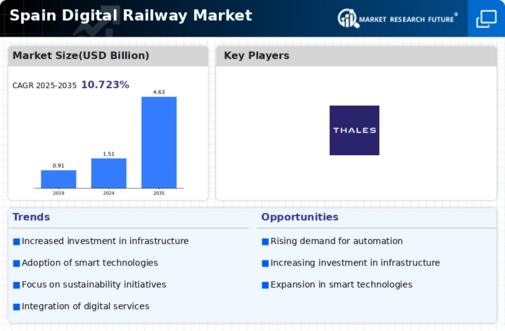

Investment in Infrastructure Modernization

Investment in infrastructure modernization is a critical driver for the digital railway market in Spain. The government has allocated substantial funds for upgrading existing rail networks and integrating digital technologies. Recent reports indicate that approximately €1.5 billion is earmarked for infrastructure projects over the next five years. This investment is expected to enhance the reliability and efficiency of rail services, thereby attracting more passengers. Additionally, the modernization efforts include the implementation of advanced signaling systems and energy-efficient trains, which are essential for meeting sustainability goals. As a result, the digital railway market is poised for growth, with infrastructure improvements playing a pivotal role in shaping its future.

Regulatory Support for Digital Transformation

The digital railway market in Spain is benefiting from regulatory support aimed at fostering digital transformation. The government has introduced policies that encourage the adoption of innovative technologies in rail transport. For instance, initiatives promoting the use of smart signaling systems and automated train operations are gaining traction. These regulations not only enhance safety but also aim to reduce operational costs by up to 20%. Furthermore, the European Union's funding programs are providing financial backing for projects that align with digital railway objectives. This supportive regulatory environment is likely to accelerate the pace of digitalization in the railway sector, positioning Spain as a leader in the digital railway market.