Rising Mental Health Awareness

The increasing awareness surrounding mental health issues in Spain is a pivotal driver for the digital mental-health market. Public campaigns and educational initiatives have contributed to a cultural shift, encouraging individuals to seek help. As of 2025, approximately 30% of the Spanish population acknowledges mental health as a critical aspect of overall well-being. This heightened awareness is likely to propel the demand for digital solutions, as individuals seek accessible and convenient options for support. The digital mental-health market is thus positioned to benefit from this trend, as more people turn to online platforms for therapy and resources. Furthermore, the stigma associated with mental health is gradually diminishing, which may lead to increased utilization of digital services, ultimately expanding the market's reach and potential.

Government Initiatives and Funding

Government initiatives aimed at improving mental health services in Spain are significantly influencing the digital mental-health market. The Spanish government has allocated substantial funding to enhance mental health care, with a focus on integrating technology into service delivery. In 2025, it is estimated that public spending on mental health will reach €1.5 billion, with a portion dedicated to digital solutions. This financial support is likely to foster innovation and development within the digital mental-health market, encouraging startups and established companies to create effective digital tools. Additionally, public-private partnerships may emerge, further enhancing the availability and quality of digital mental health services. As a result, the market is expected to expand, driven by both governmental support and the increasing demand for accessible mental health care.

Integration of Mental Health into Primary Care

The integration of mental health services into primary care settings is emerging as a significant driver for the digital mental-health market in Spain. This approach aims to provide holistic care, addressing both physical and mental health needs. As of 2025, approximately 25% of primary care facilities in Spain are expected to incorporate digital mental health tools, facilitating early intervention and ongoing support. This integration may lead to increased referrals to digital mental health services, as healthcare providers recognize the importance of addressing mental health issues. The digital mental-health market stands to benefit from this trend, as it aligns with the broader healthcare system's goals of improving patient outcomes and enhancing the overall quality of care.

Technological Advancements in Digital Solutions

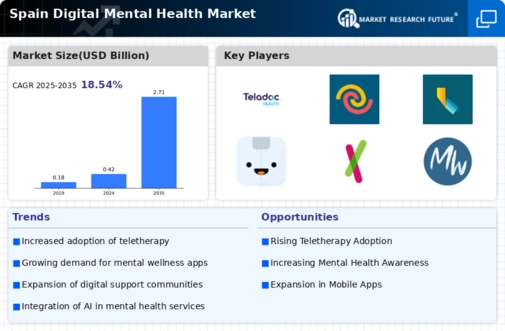

Technological advancements are playing a crucial role in shaping the digital mental-health market in Spain. Innovations such as mobile applications, virtual reality, and artificial intelligence are enhancing the effectiveness of mental health interventions. By 2025, it is projected that the use of mobile health applications will increase by 40%, providing users with tools for self-assessment, therapy, and support. These advancements not only improve user engagement but also facilitate personalized care, which is essential in the digital mental-health market. As technology continues to evolve, it is likely that new solutions will emerge, catering to diverse mental health needs. This dynamic environment may attract investment and drive competition, ultimately benefiting consumers seeking effective digital mental health resources.

Increased Demand for Flexible Mental Health Services

The demand for flexible mental health services is on the rise in Spain, significantly impacting the digital mental-health market. Individuals are increasingly seeking solutions that fit their busy lifestyles, leading to a preference for online therapy and self-help resources. In 2025, it is estimated that 50% of individuals seeking mental health support will prefer digital platforms over traditional in-person visits. This shift indicates a growing acceptance of digital solutions as viable alternatives. The digital mental-health market is thus likely to expand, as providers adapt to meet this demand by offering a range of services, including on-demand therapy sessions and asynchronous support. This flexibility not only enhances accessibility but also encourages more individuals to engage with mental health services.