Rising Healthcare Expenditure

Spain's increasing healthcare expenditure is a significant driver for the dental sleep-medicine market. As the government allocates more resources to healthcare, there is a growing emphasis on preventive care and the management of chronic conditions, including sleep disorders. This trend is likely to result in higher investments in dental sleep-medicine services and technologies. With healthcare spending projected to reach approximately €200 billion by 2026, the dental sleep-medicine market stands to benefit from enhanced funding for research, development, and patient education initiatives. This financial support may lead to improved treatment options and greater accessibility for patients seeking dental solutions for sleep-related issues.

Enhanced Public Awareness Campaigns

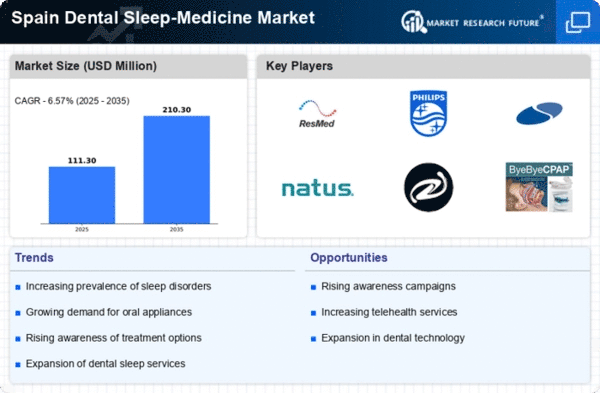

Public awareness campaigns in Spain are increasingly focusing on the importance of sleep health, which is positively impacting the dental sleep-medicine market. These campaigns aim to educate the population about the risks associated with untreated sleep disorders, such as cardiovascular diseases and diabetes. As awareness grows, more individuals are likely to seek dental interventions for sleep apnea and other related conditions. As a result of these educational efforts, the dental sleep-medicine market is expected to see a surge in demand. This may lead to earlier diagnosis and treatment. This proactive approach to sleep health could significantly enhance the market's growth trajectory in the coming years.

Increasing Prevalence of Sleep Apnea

The rising incidence of sleep apnea in Spain is a crucial driver for the dental sleep-medicine market. Recent studies indicate that approximately 4.5 million individuals in Spain suffer from obstructive sleep apnea, a condition that significantly impacts quality of life. This growing prevalence necessitates effective treatment options, leading to an increased demand for dental appliances designed to manage sleep apnea. As awareness of the condition spreads, more patients are seeking dental interventions, thereby expanding the market. The dental sleep-medicine market is projected to grow. This growth is due to healthcare providers increasingly recognizing the importance of dental solutions in treating sleep disorders. This trend suggests a potential increase in collaboration between dental professionals and sleep specialists, further driving market growth.

Regulatory Support for Dental Sleep Solutions

Regulatory frameworks in Spain are evolving to support the integration of dental sleep solutions into mainstream healthcare. The Spanish government has recognized the importance of addressing sleep disorders, leading to initiatives that promote awareness and treatment options. This regulatory support is likely to enhance the credibility of dental sleep-medicine practices, encouraging more dental professionals to offer sleep-related services. Furthermore, reimbursement policies for dental sleep appliances are becoming more favorable, which could incentivize patients to seek treatment. As a result, the dental sleep-medicine market is expected to benefit from these supportive measures, potentially increasing accessibility and affordability of dental sleep solutions for the population.

Growing Demand for Non-Invasive Treatment Options

There is a notable shift in patient preference towards non-invasive treatment options for sleep disorders in Spain. Many individuals are increasingly reluctant to undergo surgical procedures, opting instead for dental appliances that offer effective management of conditions like sleep apnea. This trend is driving the dental sleep-medicine market, as dental professionals are adapting their practices to meet this demand. The market for oral appliances is projected to expand, with estimates suggesting a growth rate of around 8% annually. This shift towards non-invasive solutions reflects a broader societal trend favoring less invasive healthcare interventions, which could further enhance the market's growth prospects.