Emergence of Edge Computing

The rise of edge computing is influencing the cluster computing market in Spain. As IoT devices proliferate, there is a growing need for processing data closer to the source to reduce latency and bandwidth usage. Edge computing complements cluster computing by enabling localized data processing while still leveraging centralized resources for more complex tasks. This hybrid approach is particularly beneficial for industries such as manufacturing and smart cities, where real-time data analysis is crucial. The edge computing market in Spain is projected to grow at a CAGR of 30% through 2027, suggesting a significant opportunity for the cluster computing market to adapt and integrate with edge solutions, thereby enhancing overall system performance.

Rising Cybersecurity Concerns

As cyber threats become increasingly sophisticated, the need for robust cybersecurity measures is driving the cluster computing market in Spain. Organizations are recognizing the importance of securing their data and computing resources, leading to a heightened demand for advanced security solutions. Cluster computing can enhance security by enabling distributed processing and redundancy, which can mitigate the impact of potential attacks. The cybersecurity market in Spain is expected to reach €3 billion by 2025, indicating a growing focus on protecting digital assets. This trend suggests that the cluster computing market will likely see increased investment in security features and solutions, as businesses prioritize safeguarding their operations against cyber threats.

Advancements in Cloud Computing

The evolution of cloud computing technologies is reshaping the landscape of the cluster computing market in Spain. With the increasing adoption of cloud services, organizations are looking for scalable and flexible computing solutions. Cloud-based cluster computing allows businesses to leverage distributed resources, enhancing computational power without the need for substantial upfront investments. The Spanish cloud computing market is expected to reach €10 billion by 2025, indicating a robust growth trajectory. This shift towards cloud infrastructure is likely to drive the demand for cluster computing solutions, as companies seek to optimize their IT resources and improve operational efficiency. The cluster computing market stands to gain from this trend, as more enterprises transition to cloud-based environments.

Increased Data Processing Needs

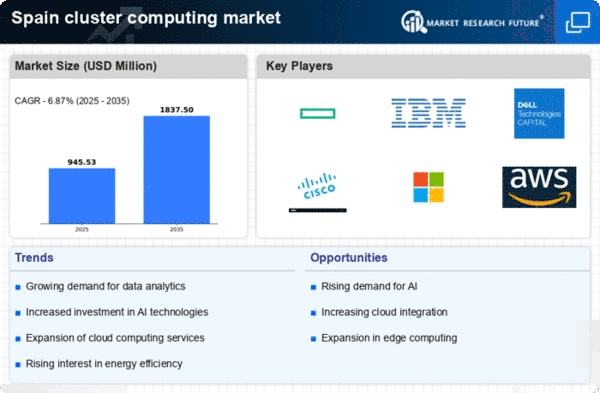

The surge in data generation across various sectors in Spain is driving the cluster computing market. Organizations are increasingly reliant on data analytics to derive insights, optimize operations, and enhance decision-making. This trend is particularly evident in industries such as finance, healthcare, and telecommunications, where vast amounts of data are processed daily. According to recent estimates, the data analytics market in Spain is projected to grow at a CAGR of 25% through 2026. Consequently, the demand for cluster computing solutions, which facilitate efficient data processing and management, is likely to rise significantly. As businesses seek to harness the power of big data, the cluster computing market is positioned to benefit from this growing need for advanced computing capabilities.

Growing Focus on Research and Development

Spain's commitment to innovation and research is fostering growth in the cluster computing market. The government and private sector are investing heavily in R&D initiatives, particularly in fields such as biotechnology, aerospace, and renewable energy. These sectors require substantial computational resources for simulations, modeling, and data analysis, which cluster computing can provide. Recent reports indicate that R&D spending in Spain has increased by 15% over the past year, reflecting a strong emphasis on technological advancement. As research institutions and companies seek to enhance their computational capabilities, the cluster computing market is likely to experience increased demand for high-performance computing solutions tailored to meet the needs of various research applications.