Adoption of Smart Devices

The proliferation of smart devices in Spain is significantly influencing the cloud tv market. As of November 2025, it is estimated that over 70% of households own smart TVs or streaming devices, which facilitate easy access to cloud-based content. This trend indicates a shift towards a more integrated viewing experience, where consumers can seamlessly transition between different platforms and devices. The cloud tv market is poised to capitalize on this trend, as the convenience of accessing content on various devices encourages higher consumption rates. Moreover, the integration of voice-activated technology and smart home systems further enhances user engagement, suggesting that the cloud tv market will continue to thrive as more consumers embrace these technologies.

Rising Internet Penetration

The cloud tv market in Spain is experiencing a notable boost due to the increasing penetration of high-speed internet services. As of 2025, approximately 90% of households have access to broadband connections, facilitating seamless streaming experiences. This connectivity allows consumers to access a wide array of content without interruptions, thereby enhancing user engagement. The cloud tv market is likely to benefit from this trend, as more users are inclined to subscribe to streaming services that offer diverse programming. Furthermore, the availability of affordable data plans encourages users to consume content on multiple devices, further driving the growth of the cloud tv market. This trend suggests that as internet access continues to expand, the cloud tv market will likely see a corresponding increase in subscriptions and viewership.

Shift in Consumer Viewing Habits

In recent years, there has been a significant shift in consumer viewing habits in Spain, with audiences increasingly favoring on-demand content over traditional television. This change is reflected in the cloud tv market, where subscription-based services are gaining traction. Data indicates that around 60% of Spanish viewers prefer streaming services for their flexibility and variety of content. This shift is not merely a trend but appears to be a fundamental change in how content is consumed. As viewers seek personalized experiences, cloud tv platforms are adapting by offering tailored recommendations and exclusive content. This evolution in viewing preferences is likely to propel the cloud tv market forward, as providers strive to meet the demands of a more discerning audience.

Increased Competition Among Providers

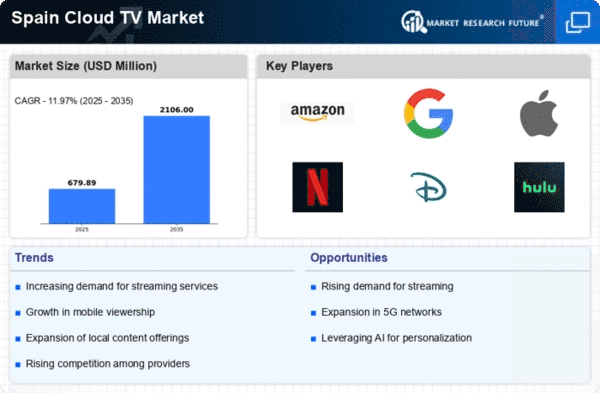

The cloud tv market in Spain is witnessing intensified competition among various service providers, which is reshaping the landscape of content delivery. With numerous players entering the market, including both established broadcasters and new entrants, consumers are presented with a plethora of options. This competitive environment is driving innovation and leading to improved service offerings, such as enhanced user interfaces and exclusive content deals. As of 2025, the market is projected to grow at a CAGR of 15%, indicating a robust demand for cloud tv services. The cloud tv market is likely to benefit from this competition, as providers strive to differentiate themselves through unique content and superior user experiences, ultimately attracting a larger subscriber base.

Growing Interest in Interactive Content

There is a burgeoning interest in interactive content within the cloud tv market in Spain, which is reshaping viewer engagement strategies. As audiences seek more immersive experiences, platforms are increasingly incorporating interactive features such as live polls, choose-your-own-adventure narratives, and social media integration. This trend is particularly appealing to younger demographics, who are more inclined to engage with content that allows for participation. The cloud tv market is likely to see a rise in subscriptions as providers innovate to meet these demands. Data suggests that interactive content can increase viewer retention by up to 30%, indicating a strong potential for growth in this segment. As the market evolves, the emphasis on interactivity may redefine how content is created and consumed.