Increased Healthcare Expenditure

Spain's healthcare expenditure has been on the rise, which significantly impacts the cardiovascular devices market. The government has allocated substantial budgets to enhance healthcare services, with a focus on advanced medical technologies. In 2025, healthcare spending is expected to reach approximately €200 billion, reflecting a commitment to improving health outcomes. This increase in funding allows for the procurement of innovative cardiovascular devices, which are essential for effective diagnosis and treatment. Moreover, the emphasis on improving healthcare infrastructure facilitates the integration of cutting-edge technologies into clinical practice. As a result, the cardiovascular devices market is likely to benefit from this financial support, enabling healthcare providers to offer better services and improve patient outcomes.

Growing Awareness of Heart Health

There is a notable increase in public awareness regarding heart health in Spain, which serves as a significant driver for the cardiovascular devices market. Campaigns promoting heart health and preventive measures have gained traction, leading to a more informed population. This heightened awareness encourages individuals to seek medical advice and undergo regular check-ups, thereby increasing the demand for cardiovascular devices. Reports indicate that around 40% of the population is now more proactive about their cardiovascular health, resulting in a surge in diagnostic procedures and treatments. Consequently, the cardiovascular devices market is experiencing growth as healthcare providers respond to this demand by offering advanced solutions tailored to patient needs.

Supportive Regulatory Environment

The regulatory environment in Spain is becoming increasingly supportive of advancements in the cardiovascular devices market. Regulatory bodies are streamlining approval processes for new medical devices, which facilitates quicker access to innovative technologies. This supportive framework encourages manufacturers to invest in research and development, knowing that their products can reach the market more efficiently. In recent years, the European Union has implemented regulations that promote safety and efficacy while also expediting the approval of breakthrough devices. As a result, the cardiovascular devices market is likely to see a surge in new product launches, enhancing the variety of options available to healthcare providers and patients alike.

Technological Innovations in Medical Devices

Technological innovations are transforming the landscape of the cardiovascular devices market in Spain. The introduction of minimally invasive procedures and advanced imaging technologies has revolutionized how cardiovascular diseases are diagnosed and treated. For instance, the development of bioresorbable stents and wearable heart monitors exemplifies the shift towards more patient-friendly solutions. These innovations not only enhance the efficacy of treatments but also improve patient recovery times. The cardiovascular devices market is projected to expand as manufacturers invest in research and development to create next-generation devices. This trend indicates a promising future for the market, as healthcare providers increasingly adopt these advanced technologies to improve patient care.

Aging Population and Rising Cardiovascular Diseases

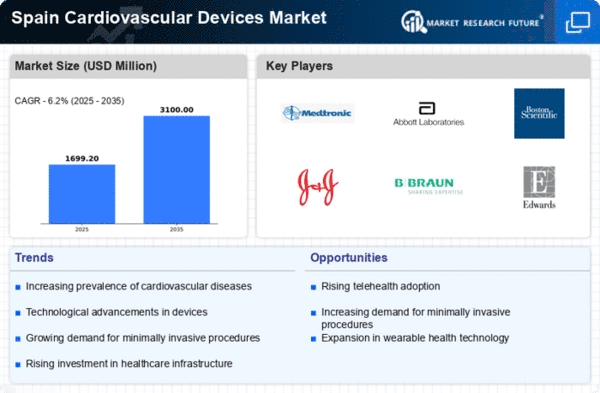

The aging population in Spain is a critical driver for the cardiovascular devices market. As individuals age, the prevalence of cardiovascular diseases tends to increase, leading to a higher demand for medical interventions. According to recent statistics, approximately 30% of the Spanish population is over 65 years old, a demographic that is particularly susceptible to heart-related ailments. This demographic shift necessitates the development and deployment of advanced cardiovascular devices to manage and treat these conditions effectively. Furthermore, the cardiovascular devices market is projected to grow at a CAGR of 6.2% in Spain, driven by the increasing incidence of heart diseases among the elderly. The healthcare system is thus compelled to adapt, ensuring that adequate resources and technologies are available to address the needs of this growing patient population.