Regulatory Pressures

The regulatory landscape in Spain is evolving, with stricter data protection laws and cybersecurity regulations being implemented. The General Data Protection Regulation (GDPR) has heightened the focus on data security, compelling organizations to adopt comprehensive cybersecurity strategies, including botnet detection solutions. Non-compliance can result in hefty fines, which further incentivizes businesses to invest in effective detection technologies. The botnet detection market is likely to benefit from these regulatory pressures, as organizations strive to meet compliance requirements while protecting sensitive data from botnet-related threats. This trend indicates a growing recognition of the importance of cybersecurity in maintaining regulatory compliance.

Rising Cyber Threats

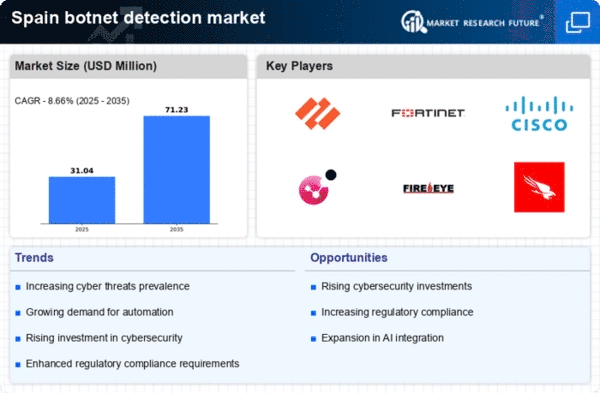

The botnet detection market in Spain is experiencing growth due to the increasing frequency and sophistication of cyber threats. Cybercriminals are leveraging botnets to execute Distributed Denial of Service (DDoS) attacks, which have surged by approximately 30% in recent years. This alarming trend compels organizations to invest in robust botnet detection solutions to safeguard their digital assets. The Spanish government has also recognized the urgency of this issue, prompting initiatives aimed at enhancing national cybersecurity. As a result, the botnet detection market is projected to expand significantly, with an estimated growth rate of 15% annually. This environment creates a pressing need for advanced detection technologies that can identify and mitigate botnet activities effectively.

Increased Digital Transformation

Spain's ongoing digital transformation across various sectors is a key driver for the botnet detection market. As businesses increasingly adopt cloud services and IoT devices, the attack surface for cyber threats expands, making them more vulnerable to botnet attacks. Reports indicate that over 60% of Spanish companies have migrated to cloud-based solutions, which, while beneficial, also necessitate enhanced security measures. Consequently, organizations are prioritizing investments in botnet detection technologies to protect their networks and data. The botnet detection market is likely to see a surge in demand as companies seek to fortify their defenses against evolving cyber threats associated with digital transformation.

Emergence of Advanced Technologies

The emergence of advanced technologies, such as artificial intelligence and machine learning, is transforming the botnet detection market in Spain. These technologies enhance the ability to detect and respond to botnet activities in real-time, significantly improving the effectiveness of detection solutions. Companies are increasingly integrating AI-driven tools into their cybersecurity frameworks, which can analyze vast amounts of data to identify patterns indicative of botnet behavior. This integration is expected to drive market growth, as organizations seek to leverage innovative technologies to bolster their defenses. The botnet detection market is poised for expansion as businesses recognize the potential of advanced technologies in combating cyber threats.

Growing Awareness of Cybersecurity Risks

There is a notable increase in awareness regarding cybersecurity risks among businesses and consumers in Spain. This heightened awareness is driving demand for effective botnet detection solutions. Educational campaigns and government initiatives have contributed to a better understanding of the potential consequences of cyber attacks, including financial losses and reputational damage. As a result, organizations are more inclined to allocate budgets towards cybersecurity measures, with a reported increase of 25% in spending on security solutions in the past year. This trend is expected to bolster the botnet detection market, as companies recognize the necessity of proactive measures to combat botnet threats.