Supportive Regulatory Environment

A supportive regulatory environment is fostering growth in the biochips market in Spain. Regulatory bodies are increasingly recognizing the potential of biochips in enhancing diagnostic accuracy and patient care. Streamlined approval processes for biochip technologies are encouraging innovation and facilitating market entry for new products. In 2025, it is anticipated that regulatory frameworks will continue to evolve, providing clearer guidelines for biochip development and commercialization. This supportive landscape is likely to attract more players to the biochips market, driving competition and innovation. As a result, the market may experience accelerated growth, benefiting from the introduction of novel biochip solutions that meet regulatory standards.

Rising Prevalence of Chronic Diseases

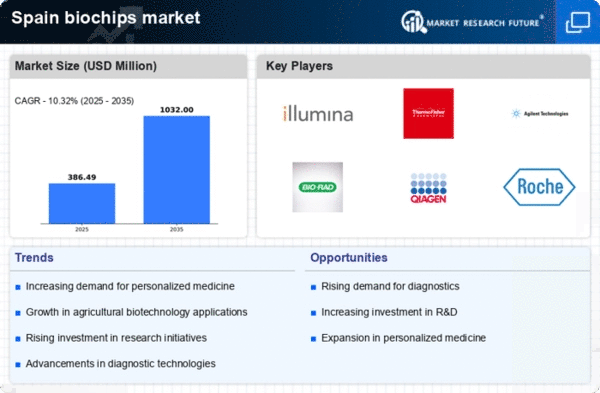

The increasing prevalence of chronic diseases in Spain is significantly impacting the biochips market. Conditions such as diabetes, cancer, and cardiovascular diseases are on the rise, necessitating advanced diagnostic tools for early detection and management. Biochips offer a promising solution by enabling rapid and accurate testing, which is crucial for effective treatment strategies. The market is expected to witness a growth rate of around 10% annually as healthcare providers seek to integrate biochip technology into routine diagnostics. This trend highlights the potential of the biochips market to address pressing healthcare challenges, ultimately improving patient outcomes and reducing healthcare costs.

Increasing Demand for Point-of-Care Testing

The demand for point-of-care testing (POCT) is rapidly increasing in Spain, significantly influencing the biochips market. Healthcare providers are seeking efficient and rapid diagnostic solutions that can be deployed in various settings, including clinics and remote locations. Biochips are well-suited for POCT applications due to their compact size and ability to deliver quick results. The market for biochips in POCT is projected to grow by approximately 15% over the next few years, driven by the need for timely diagnosis and treatment. This trend indicates a strong potential for the biochips market to expand its offerings, catering to the evolving needs of healthcare systems and improving access to essential diagnostic services.

Growing Investment in Biotechnology Research

Investment in biotechnology research is a key driver for the biochips market in Spain. The Spanish government, alongside private sector stakeholders, is increasing funding for research initiatives aimed at developing innovative biochip applications. In 2025, it is estimated that public and private investments in biotechnology could reach €1 billion, reflecting a growing recognition of the importance of biochips in drug discovery and disease diagnostics. This influx of capital is likely to foster collaborations between academic institutions and industry players, further propelling advancements in biochip technology. The biochips market stands to benefit from this trend, as enhanced research capabilities lead to the development of novel biochip solutions tailored to specific medical needs.

Technological Advancements in Biochip Manufacturing

The biochips market in Spain is experiencing a surge due to rapid technological advancements in biochip manufacturing processes. Innovations such as microfluidics and nanotechnology are enhancing the efficiency and accuracy of biochips. These advancements enable the production of smaller, more efficient biochips that can perform complex analyses with minimal sample sizes. As a result, the market is projected to grow at a CAGR of approximately 12% over the next five years. This growth is driven by the increasing demand for high-throughput screening and personalized diagnostics, which are becoming essential in clinical settings. The biochips market is thus poised for significant expansion as manufacturers adopt these cutting-edge technologies to meet the evolving needs of healthcare providers.