Growing Focus on Data Analytics

The automated infrastructure-management-aim-solutions market is witnessing a growing focus on data analytics as organizations seek to leverage insights for better decision-making. The ability to analyze vast amounts of data in real-time allows businesses to optimize their infrastructure management processes. In Spain, companies that adopt data-driven approaches can potentially improve their operational efficiency by 20%. This trend indicates a shift towards more intelligent infrastructure management solutions that not only automate processes but also provide actionable insights, thereby enhancing overall performance.

Increased Cybersecurity Concerns

In the context of the automated infrastructure-management-aim-solutions market, heightened cybersecurity concerns are propelling organizations to invest in advanced management solutions. With the rise in cyber threats, businesses in Spain are prioritizing the protection of their digital assets. Automated solutions that incorporate robust security features are becoming essential. Reports suggest that organizations that utilize automated infrastructure management can reduce the risk of security breaches by approximately 40%. This growing emphasis on cybersecurity is likely to drive the demand for sophisticated automated solutions, thereby fostering market growth.

Supportive Government Initiatives

Government initiatives aimed at promoting digital transformation are playing a crucial role in shaping the automated infrastructure-management-aim-solutions market. In Spain, various programs and funding opportunities are being introduced to encourage businesses to adopt advanced technologies. These initiatives are designed to enhance competitiveness and drive innovation across sectors. As a result, organizations are more inclined to invest in automated solutions that align with government objectives. This supportive environment is likely to stimulate market growth, as businesses seek to capitalize on available resources and incentives.

Shift Towards Cloud-Based Solutions

The transition to cloud-based infrastructure is significantly influencing the automated infrastructure-management-aim-solutions market. As businesses in Spain increasingly migrate to cloud environments, the need for automated management solutions that can seamlessly integrate with these platforms is becoming apparent. Cloud-based solutions offer scalability, flexibility, and cost-effectiveness, which are appealing to organizations aiming to enhance their operational capabilities. Data indicates that the cloud services market in Spain is projected to grow by 25% annually, suggesting a corresponding rise in demand for automated management solutions that cater to cloud infrastructures.

Rising Demand for Operational Efficiency

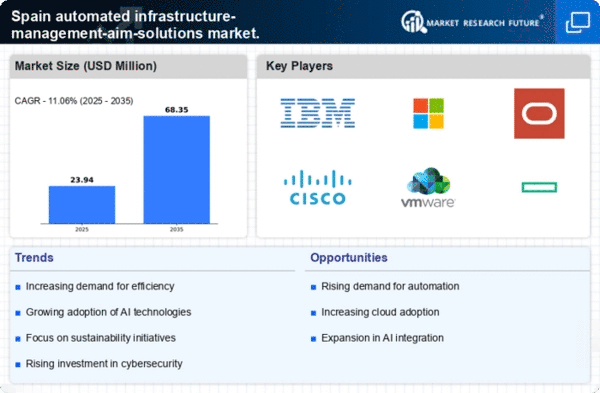

The automated infrastructure-management-aim-solutions market in Spain is experiencing a notable surge in demand for operational efficiency. Organizations are increasingly seeking solutions that streamline processes, reduce downtime, and enhance productivity. This trend is driven by the need to optimize resource allocation and minimize operational costs. According to recent data, companies that implement automated solutions can achieve up to 30% reduction in operational expenses. As businesses strive to remain competitive, the adoption of automated infrastructure management tools is likely to accelerate, indicating a robust growth trajectory for the market.