Rising Focus on Immunotherapy

The antibody drug-discovery market is benefiting from a rising focus on immunotherapy as a treatment modality in Spain. With an increasing understanding of the immune system's role in combating diseases, particularly cancer, there is a growing interest in developing antibody-based therapies that harness the body's immune response. Clinical trials and research studies are increasingly demonstrating the efficacy of monoclonal antibodies in treating various malignancies, leading to a surge in investment in this area. The Spanish oncology landscape is evolving, with more institutions dedicating resources to immunotherapy research. This shift is likely to propel the antibody drug-discovery market forward, as it aligns with the broader trend of personalized medicine. Analysts predict that the market could see a growth rate of around 10% annually as more immunotherapeutic agents are developed and approved.

Supportive Government Initiatives

In Spain, government initiatives aimed at fostering innovation in the healthcare sector are playing a crucial role in the antibody drug-discovery market. The Spanish government has implemented various funding programs and grants to support research and development in biotechnology. For instance, the Spanish National Research Agency has allocated substantial resources to projects focused on antibody development. These initiatives not only provide financial backing but also create a conducive environment for collaboration between research institutions and pharmaceutical companies. As a result, the antibody drug-discovery market is likely to benefit from increased research output and the commercialization of novel therapies. The government’s commitment to enhancing the biotechnology landscape is expected to drive market growth, potentially leading to a 15% increase in new antibody therapies entering the market by 2027.

Growing Demand for Targeted Therapies

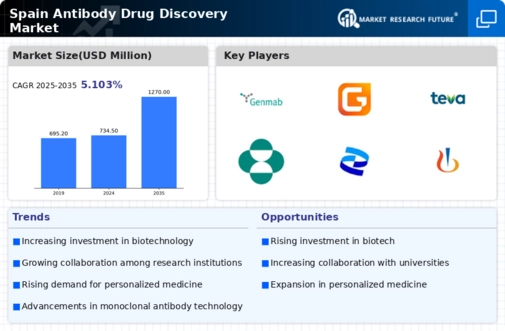

The antibody drug-discovery market in Spain is experiencing a notable surge in demand for targeted therapies. This trend is driven by the increasing prevalence of chronic diseases, such as cancer and autoimmune disorders, which require more precise treatment options. In recent years, the Spanish healthcare system has prioritized personalized medicine, leading to a greater focus on developing monoclonal antibodies that can specifically target disease mechanisms. As a result, the market is projected to grow at a CAGR of approximately 8% over the next five years. This growth is further supported by advancements in technology that enhance the efficiency of antibody discovery processes, thereby attracting investments from both public and private sectors. Consequently, the antibody drug-discovery market is poised to expand significantly as healthcare providers seek innovative solutions to improve patient outcomes.

Increased Collaboration Among Stakeholders

Collaboration among various stakeholders is emerging as a key driver in the antibody drug-discovery market in Spain. Partnerships between academic institutions, biotechnology firms, and pharmaceutical companies are becoming increasingly common, facilitating knowledge exchange and resource sharing. These collaborations often lead to innovative approaches in antibody discovery and development, enhancing the overall efficiency of the drug development process. For instance, joint ventures may focus on specific therapeutic areas, pooling expertise and funding to accelerate research timelines. This collaborative environment is likely to foster the emergence of novel therapies, thereby expanding the antibody drug-discovery market. As stakeholders recognize the benefits of working together, the market may experience a growth trajectory that reflects the collective efforts of these diverse entities, potentially increasing the number of successful drug candidates by 30% in the coming years.

Advancements in Biomanufacturing Technologies

The antibody drug-discovery market is significantly influenced by advancements in biomanufacturing technologies in Spain. Innovations in production processes, such as the use of mammalian cell cultures and continuous manufacturing techniques, are enhancing the efficiency and scalability of antibody production. These technological improvements are crucial for meeting the rising demand for therapeutic antibodies, which are often complex molecules requiring sophisticated manufacturing capabilities. Furthermore, the integration of automation and artificial intelligence in biomanufacturing is streamlining operations, reducing costs, and minimizing time-to-market for new therapies. As a result, the antibody drug-discovery market is expected to witness a transformation in production capabilities, potentially increasing output by 20% over the next few years. This evolution in manufacturing is likely to attract further investments and partnerships within the industry.