Growing Awareness of Skin Health

There is a marked increase in awareness regarding skin health among the Spanish population, which is positively influencing the aesthetic lasers market. Consumers are becoming more informed about the benefits of laser treatments for various skin conditions, including pigmentation issues, acne scars, and signs of aging. This heightened awareness is reflected in the rising number of consultations for laser treatments, with reports indicating a 25% increase in inquiries over the past year. As individuals prioritize skin health and appearance, is likely to benefit from this trend. Educational campaigns and social media influence further contribute to this awareness, encouraging more people to seek professional aesthetic services.

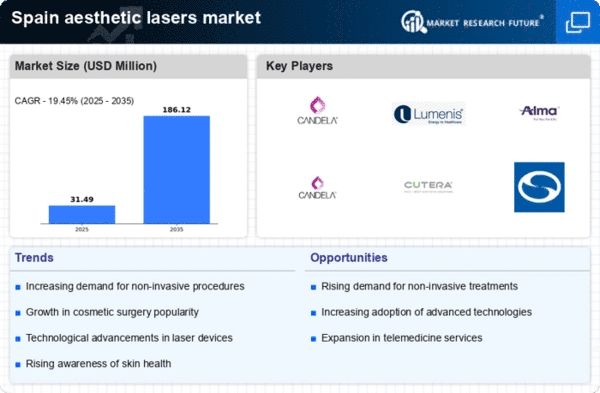

Rising Demand for Non-Invasive Procedures

The aesthetic lasers market in Spain experiences a notable increase in demand for non-invasive cosmetic procedures. This trend is driven by a growing preference among consumers for treatments that offer minimal downtime and reduced recovery periods. According to recent data, non-invasive procedures account for approximately 70% of the total aesthetic treatments performed in Spain. As individuals seek effective solutions for skin rejuvenation, hair removal, and other aesthetic concerns, is poised for growth. The appeal of non-invasive options aligns with the broader societal shift towards self-care and wellness, further propelling the market forward. Clinics and practitioners are increasingly adopting advanced laser technologies to meet this demand, indicating a robust future for the aesthetic lasers market in Spain.

Increasing Investment in Aesthetic Clinics

Investment in aesthetic clinics across Spain is on the rise, significantly impacting the aesthetic lasers market. As the beauty and wellness industry expands, more entrepreneurs and established medical professionals are entering the market, leading to a proliferation of aesthetic clinics. This growth is reflected in the estimated €1.5 billion market size for aesthetic procedures in Spain, with lasers playing a crucial role in various treatments. Enhanced competition among clinics drives innovation and the adoption of cutting-edge laser technologies, which may improve treatment outcomes and patient satisfaction. Furthermore, the influx of capital into the aesthetic sector suggests a promising trajectory for the aesthetic lasers market, as clinics strive to offer the latest advancements to attract clientele.

Influence of Social Media on Beauty Standards

The aesthetic lasers market in Spain is significantly influenced by the evolving beauty standards propagated through social media platforms. As influencers and celebrities showcase their aesthetic treatments, there is a growing societal acceptance of cosmetic procedures, including laser treatments. This trend is particularly evident among younger demographics, who are increasingly seeking aesthetic enhancements to align with perceived beauty ideals. The aesthetic lasers market is likely to see a surge in demand as social media continues to shape consumer perceptions and expectations. Additionally, the visibility of successful treatment results on these platforms encourages individuals to explore laser options, further driving market growth. The interplay between social media and beauty standards presents both challenges and opportunities for the aesthetic lasers market.

Technological Innovations in Laser Treatments

Technological innovations are reshaping the aesthetic lasers market in Spain, as new laser systems and techniques emerge. Advancements in laser technology, such as the development of fractional lasers and picosecond lasers, enhance treatment efficacy and safety. These innovations allow for more precise targeting of skin issues, resulting in improved patient outcomes and satisfaction. The market is witnessing a shift towards devices that offer versatility in treating various conditions, which may attract a broader clientele. As practitioners adopt these advanced technologies, the aesthetic lasers market is expected to expand, driven by the demand for effective and safe treatment options. The continuous evolution of laser technology suggests a dynamic future for the industry.