Top Industry Leaders in the Space Technology Market

Strategies Adopted: Key players in the Space Technology Market employ various strategies to maintain their competitive edge and drive innovation. These strategies include:

Vertical Integration: Companies like SpaceX and Blue Origin vertically integrate their operations, from satellite manufacturing to launch services, allowing them to streamline processes, reduce costs, and maintain control over key aspects of the space mission lifecycle.

Collaboration and Partnerships: Collaborative partnerships between space agencies, private companies, and research institutions enable knowledge sharing, resource pooling, and joint development of space technologies, enhancing capabilities and accelerating innovation.

Technological Innovation: Continuous investment in research and development drives technological innovation in areas such as reusable rockets, satellite miniaturization, propulsion systems, and in-orbit servicing, enabling companies to offer cutting-edge solutions and stay ahead of competitors.

Market Diversification: Companies diversify their product and service offerings to address multiple segments of the space market, including commercial satellite launches, government contracts, space tourism, lunar exploration, and space-based telecommunications, reducing dependency on any single market segment.

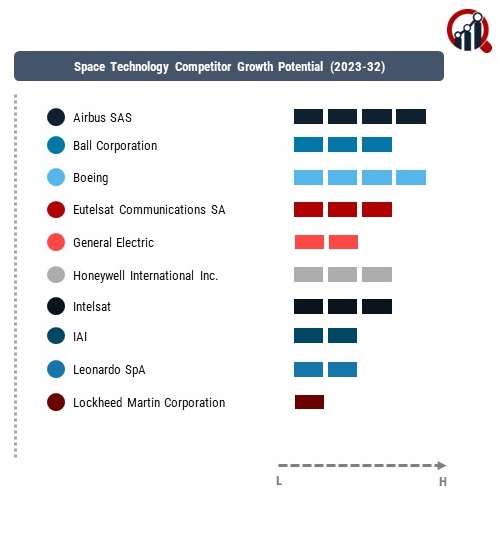

Key Companies in the Space Technology market include

Airbus SAS

Ball Corporation

Boeing

Eutelsat Communications SA

General Electric

Honeywell International Inc.

Intelsat

IAI

Leonardo SpA

Lockheed Martin Corporation

NEC Corporation

Northrop Grumman Corporation

Safran

SES SA

Space Exploration Technologies Corp

Space Systems/Loral, LLC

Teledyne Technologies Incorporated

Thales Group

Transdigm Group, Inc.

United Technologies Corporation

Viasat, Inc.

Factors for Market Share Analysis: Several factors influence market share in the Space Technology Market, including:

Launch Success Rate: The reliability and success rate of launch vehicles play a crucial role in gaining market share, with companies boasting a track record of successful launches and payload deployments attracting more customers and contracts.

Technology Differentiation: Companies that offer unique and advanced technologies, such as reusable rockets, high-resolution imaging satellites, or high-speed data transmission systems, can differentiate themselves from competitors and command premium prices.

Cost Competitiveness: Cost-effective solutions for satellite manufacturing, launch services, and in-orbit operations are key factors in gaining market share, particularly in the commercial satellite market where price sensitivity is high.

Customer Relationships: Strong relationships with government agencies, satellite operators, telecommunications companies, and other space industry stakeholders are essential for securing contracts and maintaining market share.

New and Emerging Companies: In addition to established players, new and emerging companies are entering the Space Technology Market, bringing innovative ideas and disruptive technologies. Some notable new entrants include:

Relativity Space

Rocket Lab

Momentus

Virgin Galactic

Firefly Aerospace

Astra

Vector Space Systems

Skyroot Aerospace

Astrobotic Technology

Spire Global

Industry News and Current Investment Trends: Recent developments and investment trends in the Space Technology Market reflect a growing interest in space exploration, satellite deployment, and space-based services. Key highlights include:

Increased Private Investment: Venture capital firms, private equity investors, and corporate giants are pouring billions of dollars into space startups and technology companies, fueling innovation and driving market growth.

Lunar Exploration Initiatives: Several companies are pursuing lunar exploration initiatives, including NASA's Artemis program, SpaceX's Starship missions, and commercial lunar lander projects, signaling a renewed interest in human space exploration and lunar resource utilization.

Satellite Constellation Deployment: The deployment of mega-constellations of small satellites for broadband internet connectivity, Earth observation, and global communication is accelerating, with companies like SpaceX, OneWeb, and Amazon's Project Kuiper leading the charge.

Overall Competitive Scenario: The Space Technology Market is highly competitive, with established players facing competition from both traditional aerospace giants and new entrants. Companies that prioritize technological innovation, cost competitiveness, market diversification, and customer relationships will continue to lead the market. As the space industry evolves and new opportunities emerge, companies that adapt to changing market dynamics and capitalize on emerging trends will maintain a competitive edge in the dynamic landscape of the Space Technology Market.

Space Technology Industry Developments

For Instance, April 2023

Launch of Ball Aerospace's Tropospheric Emissions Monitoring of Pollution (TEMPO) sensor from Florida's Cape Canaveral Space Force Station provides reason for celebration. The first Earth Venture instrument mission from NASA, TEMPO, will offer vital information on air pollution.

For Instance, July 2023

Collaboration on Advanced Microelectronics for Aerospace between Boeing and Intel. Boeing and Intel are collaborating strategically to advance semiconductor technology across the aerospace sector with the goal of developing next-generation microelectronics applications in artificial intelligence, secure computing, and advanced flight capabilities for future products.