Rising Demand for Visual Communication

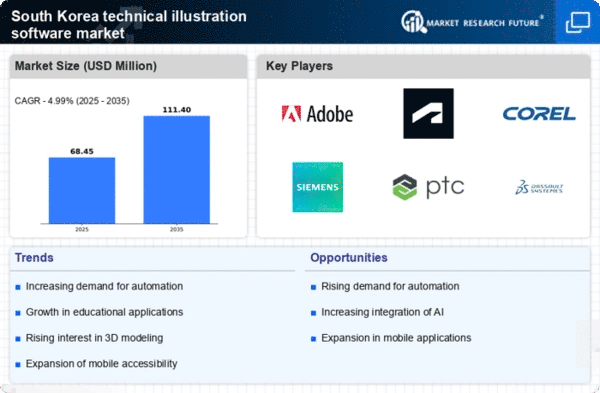

the technical illustration software market in South Korea is experiencing a notable surge in demand for visual communication tools. As industries increasingly recognize the importance of clear and effective visual representation, the need for sophisticated illustration software becomes paramount. This trend is particularly evident in sectors such as manufacturing and engineering, where precise technical drawings are essential for conveying complex information. According to recent data, the market is projected to grow at a CAGR of approximately 8% over the next five years, driven by the necessity for enhanced communication in product design and development. Companies are investing in advanced software solutions to streamline their workflows and improve collaboration, thereby propelling the growth of the technical illustration-software market. This rising demand underscores the critical role that visual communication plays in modern business practices.

Expansion of E-commerce and Digital Marketing

The expansion of e-commerce and digital marketing significantly impacts the technical illustration-software market in South Korea. As online retail continues to grow, businesses are increasingly relying on high-quality visual content to attract and retain customers. Technical illustrations play a vital role in product presentations, helping to convey information effectively and enhance the overall shopping experience. Recent data indicates that the e-commerce sector in South Korea is projected to reach $100 billion by 2025, driving demand for tools that facilitate the creation of compelling visual content. Consequently, companies are investing in technical illustration software to improve their marketing strategies and enhance product visibility. This trend suggests that the technical illustration-software market will likely benefit from the ongoing growth of e-commerce, as businesses seek to leverage visual communication to stand out in a crowded marketplace.

Technological Advancements in Software Features

Technological advancements significantly influence the technical illustration-software market in South Korea. The integration of features such as 3D modeling, augmented reality (AR), and virtual reality (VR) capabilities enhances the functionality of illustration software. These innovations allow users to create more dynamic and interactive illustrations, which are increasingly sought after in various industries, including architecture and product design. As companies strive to differentiate themselves in a competitive landscape, the adoption of cutting-edge software becomes a strategic imperative. Recent statistics indicate that the market for technical illustration software is expected to reach a valuation of $150 million by 2026, reflecting the growing investment in advanced features. This trend suggests that as technology continues to evolve, the technical illustration-software market will likely expand, driven by the demand for more sophisticated and versatile tools.

Increased Focus on Training and Skill Development

The technical illustration-software market in South Korea is witnessing an increased focus on training and skill development. As organizations recognize the importance of proficient use of illustration software, they are investing in training programs to enhance their employees' skills. This trend is particularly relevant in sectors such as education and engineering, where technical illustrations play a crucial role in conveying complex concepts. By equipping their workforce with the necessary skills, companies aim to maximize the potential of their software investments. Furthermore, educational institutions are incorporating technical illustration software into their curricula, ensuring that future professionals are well-versed in these tools. This emphasis on training is likely to contribute to the growth of the technical illustration-software market, as a skilled workforce can leverage advanced features to produce high-quality illustrations.

Growing Demand for Customization and Personalization

Customization and personalization are becoming increasingly important in the technical illustration-software market in South Korea. As businesses seek to tailor their products and services to meet specific customer needs, the demand for software that allows for personalized illustrations is on the rise. This trend is particularly evident in industries such as marketing and advertising, where unique visual content can significantly impact consumer engagement. Companies are looking for software solutions that offer flexible design options and user-friendly interfaces, enabling them to create customized illustrations efficiently. Market analysis suggests that the customization segment of the technical illustration-software market could account for up to 30% of total sales by 2027, indicating a strong shift towards personalized solutions. This growing demand for customization highlights the need for software providers to innovate and adapt their offerings to meet evolving customer expectations.