Increased Focus on Gaming Features

The rising popularity of gaming in South Korea is emerging as a crucial driver for the smart tv market. With the gaming industry experiencing substantial growth, consumers are seeking smart TVs that offer features tailored to enhance their gaming experience. This includes low input lag, high refresh rates, and compatibility with gaming consoles. Recent surveys indicate that nearly 35% of smart TV buyers in South Korea prioritize gaming features in their purchasing decisions. As a result, the smart tv market is likely to adapt by incorporating advanced gaming technologies, thereby appealing to a broader audience and capitalizing on the gaming trend.

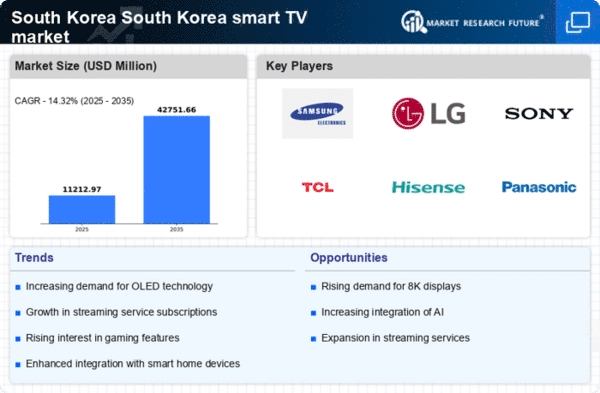

Shift Towards 4K and 8K Resolution

The transition to higher resolution displays, such as 4K and 8K, is driving growth in the smart tv market. South Korean consumers are increasingly prioritizing picture quality, leading to a surge in demand for high-resolution televisions. Recent statistics indicate that over 40% of TV sales in South Korea are now 4K or higher, reflecting a shift in consumer preferences. This trend is likely to continue as content providers expand their offerings in high-definition formats. The smart tv market is responding by innovating and producing models that support these advanced resolutions, thus catering to the evolving demands of tech-savvy consumers.

Expansion of Local Content Providers

The emergence and growth of local content providers in South Korea is a notable driver for the smart tv market. With the rise of streaming platforms that offer localized content, consumers are increasingly drawn to smart TVs that facilitate easy access to these services. Recent data suggests that local streaming services have seen a 30% increase in subscriptions over the past year, indicating a robust demand for content tailored to South Korean audiences. This trend is likely to encourage manufacturers to enhance their smart TV offerings, ensuring compatibility with popular local platforms, thereby strengthening the smart tv market.

Rising Demand for Smart Home Integration

The increasing trend of smart home technology adoption in South Korea appears to be a significant driver for the smart tv market. As consumers seek to create interconnected environments, smart TVs serve as central hubs for controlling various devices. This integration enhances user convenience and functionality, making smart TVs more appealing. According to recent data, approximately 60% of households in South Korea have adopted some form of smart home technology, which correlates with a growing interest in smart TVs. The smart tv market is likely to benefit from this trend, as manufacturers develop products that seamlessly integrate with other smart devices, thereby enhancing the overall user experience.

Technological Advancements in Display Technology

Innovations in display technology, such as OLED and QLED, are significantly influencing the smart tv market. South Korean manufacturers are at the forefront of these advancements, producing televisions that offer superior color accuracy and contrast. The adoption of these technologies is likely to attract consumers who prioritize visual quality. Recent market analysis indicates that OLED TVs account for approximately 25% of the smart TV sales in South Korea, showcasing a growing preference for high-end display options. As technology continues to evolve, the smart tv market is expected to expand further, driven by consumer demand for cutting-edge visual experiences.