Expansion of Offshore Energy Projects

The remotely operated-vehicle market is significantly impacted by the expansion of offshore energy projects in South Korea. With the country aiming to increase its renewable energy capacity, particularly in offshore wind and tidal energy, the demand for ROVs is likely to rise. These vehicles play a crucial role in the installation, maintenance, and inspection of underwater infrastructure associated with energy projects. The South Korean government has set a target to generate 20% of its energy from renewable sources by 2030, which is expected to drive investments in ROV technology. This trend suggests that as offshore energy initiatives grow, the remotely operated-vehicle market will benefit from increased utilization in supporting these projects.

Advancements in Robotics and Automation

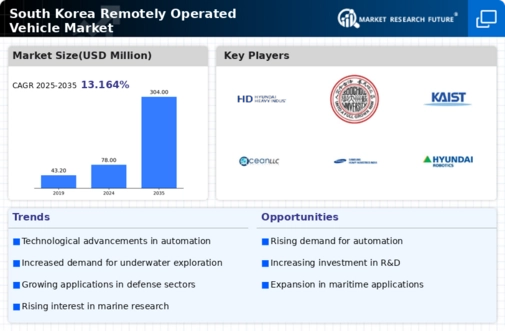

The remotely operated-vehicle market is significantly influenced by advancements in robotics and automation technologies. South Korea, known for its robust technology sector, has seen a surge in the development of sophisticated ROVs equipped with cutting-edge sensors and AI capabilities. These innovations enhance operational efficiency and reduce human intervention, making ROVs more appealing to various industries, including oil and gas, construction, and environmental monitoring. The market is projected to grow at a CAGR of 12% over the next five years, reflecting the increasing integration of automation in ROV operations. This trend suggests that as technology continues to evolve, the remotely operated-vehicle market will likely expand, driven by the demand for more intelligent and autonomous systems.

Growing Interest in Defense Applications

The remotely operated-vehicle market is witnessing a surge in interest from defense sectors in South Korea. The government has recognized the strategic importance of ROVs for surveillance, reconnaissance, and combat support. Recent investments in military technology have led to the development of advanced ROVs capable of operating in hostile environments. The South Korean defense budget for 2025 allocates approximately $3 billion for unmanned systems, which includes ROVs. This focus on defense applications not only enhances national security but also stimulates innovation within the market. As defense agencies increasingly adopt ROVs for various missions, the market is expected to experience substantial growth, indicating a promising future for the industry.

Increased Demand for Underwater Exploration

The remotely operated-vehicle market in South Korea is experiencing heightened demand for underwater exploration, driven by the country's rich marine biodiversity and the need for sustainable resource management. As industries such as fisheries and marine research expand, the requirement for advanced remotely operated vehicles (ROVs) becomes more pronounced. The South Korean government has allocated approximately $200 million to support marine research initiatives, which is likely to boost the adoption of ROVs. Furthermore, the increasing interest in underwater tourism and environmental monitoring is expected to further propel the market. This trend indicates a growing recognition of the importance of ROVs in exploring and preserving marine ecosystems, thereby enhancing the overall market landscape.

Rising Environmental Regulations and Compliance

The remotely operated-vehicle market is influenced by the rising environmental regulations and compliance requirements in South Korea. As the government enforces stricter environmental protection laws, industries are compelled to adopt ROVs for monitoring and assessing environmental impacts. ROVs are increasingly utilized for tasks such as underwater inspections, pollution monitoring, and habitat assessments, which are essential for compliance with environmental standards. The market is projected to grow as companies seek to enhance their environmental stewardship and meet regulatory demands. This trend indicates that the remotely operated-vehicle market will likely expand as industries prioritize sustainability and compliance in their operations.