Rise of Fintech Innovations

The emergence of fintech companies is reshaping the landscape of the nlp in-finance market. In South Korea, fintech firms are increasingly adopting NLP technologies to offer innovative financial solutions, such as chatbots and personalized financial advice. This trend is fostering a competitive environment where traditional banks are compelled to enhance their service offerings. By 2025, the fintech sector is expected to contribute significantly to the overall growth of the nlp in-finance market, with an estimated increase of 30% in the adoption of NLP solutions. The integration of NLP in fintech applications not only improves user experience but also drives customer engagement, making it a critical driver in the market.

Growing Demand for Automation

The increasing demand for automation in financial services significantly impacts the nlp in-finance market. South Korean financial institutions are seeking to automate routine tasks, such as data entry and report generation, to enhance efficiency and reduce operational costs. By 2025, it is estimated that automation could reduce costs by up to 30% in various financial processes. NLP technologies facilitate this automation by enabling systems to understand and process human language, thereby minimizing manual intervention. This shift towards automation not only improves productivity but also allows financial professionals to focus on more strategic tasks. Consequently, the nlp in-finance market is likely to witness substantial growth as firms invest in automation technologies.

Technological Advancements in NLP

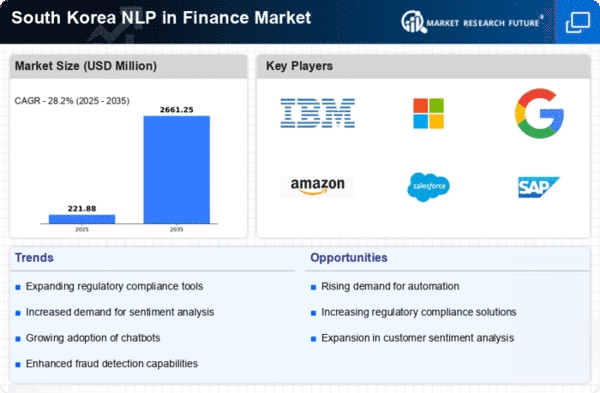

The rapid evolution of technology plays a pivotal role in the nlp in-finance market. Innovations in machine learning and artificial intelligence are enhancing the capabilities of natural language processing systems. In South Korea, the integration of advanced algorithms allows financial institutions to analyze vast amounts of unstructured data, leading to improved decision-making processes. As of 2025, the market is projected to grow at a CAGR of 25%, driven by these technological advancements. Financial firms are increasingly adopting NLP tools to streamline operations, enhance customer service, and gain insights from customer interactions. This trend indicates a strong demand for sophisticated NLP solutions, which are becoming essential for maintaining competitive advantage in the finance sector.

Increased Focus on Customer Insights

Understanding customer behavior and preferences is becoming increasingly crucial in the nlp in-finance market. South Korean financial institutions are leveraging NLP to extract valuable insights from customer interactions, social media, and feedback. This focus on customer insights is expected to drive market growth, as firms aim to tailor their services to meet evolving customer needs. By 2025, it is projected that companies utilizing NLP for customer insights will see a 20% increase in customer satisfaction rates. The ability to analyze sentiment and trends in real-time allows financial institutions to adapt their strategies swiftly, enhancing their competitive positioning in the market.

Regulatory Pressures and Compliance Needs

The nlp in-finance market is significantly influenced by the increasing regulatory pressures faced by financial institutions in South Korea. Compliance with stringent regulations requires firms to process and analyze large volumes of documentation efficiently. NLP technologies can automate the extraction of relevant information from regulatory texts, thereby streamlining compliance processes. As regulations continue to evolve, the demand for NLP solutions that can adapt to these changes is likely to rise. By 2025, it is anticipated that the market for compliance-related NLP applications will grow by 15%, as firms seek to mitigate risks associated with non-compliance and enhance their operational resilience.

Leave a Comment