Government Initiatives and Funding

The South Korean government is actively promoting the growth of the laboratory chemicals market through various initiatives and funding programs. In 2025, the government has allocated approximately $1 billion to support research in chemical sciences and innovation. This funding is aimed at enhancing the capabilities of local laboratories and fostering collaboration between academic institutions and industry players. Such initiatives are expected to stimulate the laboratory chemicals market by encouraging the development of new products and technologies. Furthermore, government support for sustainable practices in chemical production may lead to increased demand for eco-friendly laboratory chemicals, aligning with global trends towards sustainability.

Expansion of the Pharmaceutical Sector

The pharmaceutical sector in South Korea is expanding rapidly, contributing significantly to the growth of the laboratory chemicals market. With a projected market size of $30 billion by 2025, the pharmaceutical industry is increasingly reliant on laboratory chemicals for drug development, quality control, and testing. The rise in chronic diseases and an aging population are driving the demand for new medications, which in turn necessitates the use of various chemicals in laboratories. As pharmaceutical companies invest in advanced research facilities and technologies, the laboratory chemicals market is likely to see a corresponding increase in demand for high-purity chemicals and reagents essential for drug formulation and testing.

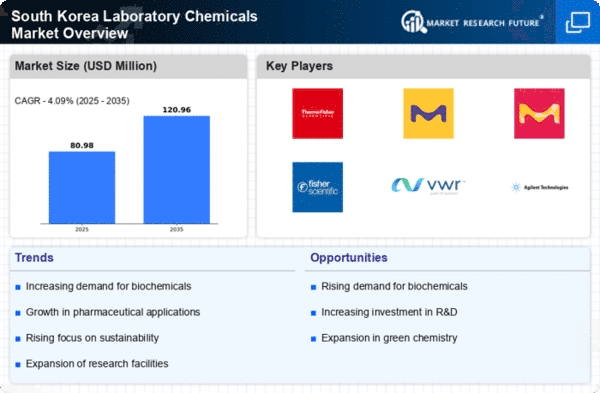

Increasing Research and Development Activities

The laboratory chemicals market in South Korea is experiencing a surge in research and development (R&D) activities across various sectors, including pharmaceuticals, biotechnology, and environmental science. This trend is driven by the need for innovative solutions and advanced materials, which necessitate the use of specialized laboratory chemicals. In 2025, R&D spending in South Korea is projected to reach approximately $25 billion, reflecting a 10% increase from the previous year. This growth in R&D is likely to create a robust demand for laboratory chemicals, as researchers require high-quality reagents and solvents to conduct experiments and develop new products. Consequently, the laboratory chemicals market is poised to benefit from this heightened focus on innovation and scientific exploration.

Rising Environmental Regulations and Compliance

The laboratory chemicals market in South Korea is being influenced by increasing environmental regulations and compliance requirements. As the government enforces stricter guidelines on chemical usage and disposal, laboratories are compelled to adopt safer and more sustainable practices. This shift is likely to drive demand for environmentally friendly laboratory chemicals, which comply with new regulations. In 2025, it is anticipated that the market for green chemicals will grow by 20%, reflecting a significant shift in consumer preferences towards sustainable options. Consequently, the laboratory chemicals market must adapt to these changes by offering products that meet regulatory standards while also addressing environmental concerns.

Growth in Educational Institutions and Training Programs

The proliferation of educational institutions and training programs in South Korea is contributing to the growth of the laboratory chemicals market. As universities and research centers expand their curricula to include advanced scientific disciplines, the demand for laboratory chemicals is likely to increase. In 2025, it is estimated that the number of graduates in science and engineering fields will rise by 15%, leading to a greater need for laboratory resources. This trend indicates a growing interest in scientific research and experimentation among students, which will subsequently drive the laboratory chemicals market. Enhanced training programs will also ensure that future scientists are well-equipped to utilize laboratory chemicals effectively in their research endeavors.