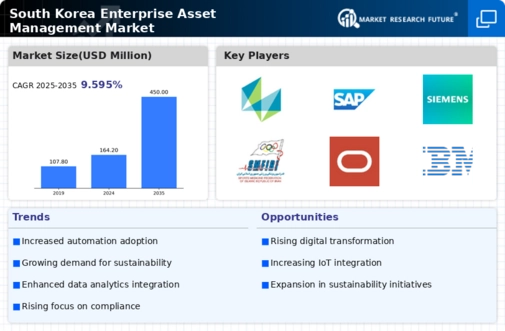

The enterprise asset-management market in South Korea is characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for operational efficiency. Key players such as IBM (US), SAP (DE), and Oracle (US) are at the forefront, leveraging their extensive portfolios to enhance service delivery and customer engagement. IBM (US) focuses on integrating AI and machine learning into its asset-management solutions, aiming to provide predictive analytics that optimize asset utilization. Meanwhile, SAP (DE) emphasizes cloud-based solutions, facilitating seamless integration across various business functions, which enhances its competitive positioning. Oracle (US) is also investing heavily in digital transformation, particularly in automating asset management processes, thereby streamlining operations and reducing costs. Collectively, these strategies not only bolster their market presence but also intensify competition, as companies strive to differentiate themselves through innovation and customer-centric solutions.

In terms of business tactics, localization of services and supply chain optimization are pivotal. The market appears moderately fragmented, with a mix of established players and emerging startups. This structure allows for diverse offerings, yet the influence of major companies remains substantial, as they set benchmarks for technology adoption and service standards. The competitive dynamics are further shaped by the need for companies to adapt to local market conditions, which often necessitates tailored solutions that resonate with regional clients.

In October 2025, SAP (DE) announced a strategic partnership with a leading South Korean telecommunications firm to enhance its cloud-based asset-management solutions. This collaboration is expected to leverage the telecom's extensive network infrastructure, thereby improving service delivery and customer access to SAP's offerings. The strategic importance of this partnership lies in its potential to expand SAP's market reach and enhance its competitive edge in a rapidly evolving digital landscape.

In September 2025, Oracle (US) launched a new suite of AI-driven asset-management tools specifically designed for the manufacturing sector in South Korea. This initiative aims to address the unique challenges faced by local manufacturers, such as equipment downtime and maintenance costs. The introduction of these tools signifies Oracle's commitment to innovation and its understanding of the local market's needs, potentially positioning it as a leader in this niche.

In August 2025, IBM (US) unveiled a new sustainability initiative aimed at integrating green practices into its asset-management solutions. This initiative focuses on helping organizations reduce their carbon footprint through better asset utilization and lifecycle management. The strategic importance of this move is twofold: it aligns with global sustainability trends and enhances IBM's appeal to environmentally conscious clients, thereby broadening its market appeal.

As of November 2025, the competitive trends in the enterprise asset-management market are increasingly defined by digitalization, sustainability, and AI integration. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing their service offerings. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology integration, and supply chain reliability. This shift underscores the importance of adaptability and forward-thinking strategies in maintaining a competitive edge in the market.

Leave a Comment