Rising Cybersecurity Concerns

The blockchain identity-management market is experiencing growth due to escalating cybersecurity threats in South Korea. As data breaches and identity theft incidents rise, organizations are increasingly seeking robust solutions to protect sensitive information. The adoption of blockchain technology offers a decentralized approach, enhancing security and reducing vulnerabilities associated with traditional identity management systems. According to recent data, the cybersecurity market in South Korea is projected to reach approximately $3 billion by 2026, indicating a strong demand for secure identity solutions. This trend suggests that businesses are prioritizing investments in blockchain identity-management systems to safeguard their operations and customer data, thereby driving market expansion.

Enhanced User Control and Privacy

The blockchain identity-management market is increasingly appealing to users due to its emphasis on enhanced control and privacy. In South Korea, consumers are becoming more aware of their data rights and are demanding solutions that allow them to manage their personal information securely. Blockchain technology enables users to have ownership of their identities, granting them the ability to share only necessary information with service providers. This shift towards user-centric identity management is expected to drive market growth, as organizations strive to meet consumer expectations for privacy and data protection. The trend indicates a potential transformation in how identities are managed, with blockchain solutions leading the way.

Government Initiatives and Funding

Government initiatives in South Korea are significantly influencing the blockchain identity-management market. The South Korean government has been actively promoting the adoption of blockchain technology across various sectors, including finance, healthcare, and public services. In 2025, the government allocated over $200 million to support blockchain projects, which includes funding for identity management solutions. This financial backing not only encourages innovation but also fosters collaboration between public and private sectors. As a result, the blockchain identity-management market is likely to benefit from increased research and development, leading to more advanced and efficient identity solutions that meet regulatory requirements and enhance user trust.

Integration with Financial Services

The blockchain identity-management market is poised for growth through its integration with financial services in South Korea. As the financial sector increasingly adopts blockchain technology for transactions and record-keeping, the need for secure identity verification becomes paramount. Financial institutions are exploring blockchain-based identity solutions to streamline customer onboarding processes and enhance compliance with regulatory standards. The market for blockchain in financial services is projected to reach $1.5 billion by 2027, highlighting the potential for identity management solutions to play a critical role in this transformation. This integration not only improves operational efficiency but also fosters trust among consumers, thereby driving the blockchain identity-management market forward.

Growing Demand for Digital Identity Solutions

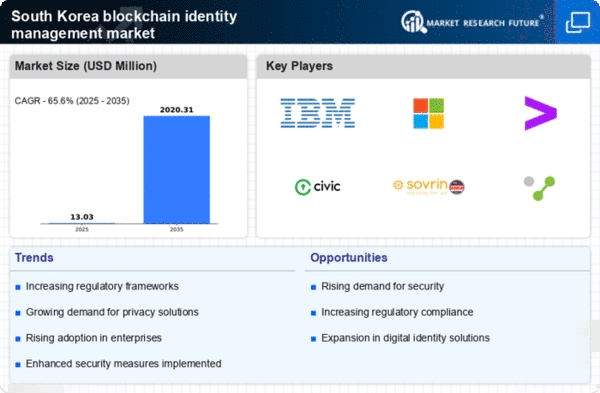

The blockchain identity-management market is witnessing a surge in demand for digital identity solutions in South Korea. With the increasing digitization of services, individuals and organizations are seeking secure and efficient ways to manage identities online. The market for digital identity verification is expected to grow at a CAGR of 25% from 2025 to 2030, reflecting a strong shift towards blockchain-based solutions. This growth is driven by the need for seamless user experiences, particularly in sectors such as e-commerce and online banking. As businesses recognize the advantages of blockchain technology in providing secure and verifiable identities, the market is likely to expand rapidly, catering to the evolving needs of consumers and enterprises alike.