Expansion of Healthcare Infrastructure

The ongoing expansion of healthcare infrastructure in South America plays a pivotal role in the vitamin d-testing market. Governments and private entities are investing in healthcare facilities, particularly in underserved areas. This expansion includes the establishment of diagnostic laboratories and clinics that offer vitamin D testing services. As of 2025, it is estimated that the number of testing facilities has increased by 30% in the last three years. This growth not only enhances accessibility but also improves the quality of testing services available to the population. Consequently, as more individuals gain access to testing, the vitamin d-testing market is likely to experience substantial growth, driven by increased consumer awareness and demand.

Growing Demand for Preventive Healthcare

The shift towards preventive healthcare in South America significantly influences the vitamin d-testing market. As healthcare systems evolve, there is a notable emphasis on early detection and prevention of diseases. This trend is reflected in the increasing number of health check-ups and screenings, including vitamin D testing. According to recent data, the preventive healthcare market is projected to grow at a CAGR of 8% over the next five years. This growth is likely to drive demand for vitamin D testing, as individuals seek to proactively manage their health. Furthermore, healthcare providers are integrating vitamin D testing into routine check-ups, making it more accessible to the general population, which could further stimulate market growth.

Rising Interest in Nutritional Supplements

The growing interest in nutritional supplements in South America is another significant driver for the vitamin d-testing market. As consumers become more health-conscious, there is an increasing trend towards the use of dietary supplements, including vitamin D. Market Research Future indicates that the vitamin D supplement market is expected to reach $500 million by 2026, reflecting a robust growth trajectory. This surge in supplement consumption correlates with a heightened awareness of the importance of vitamin D for overall health. Consequently, individuals are more inclined to undergo testing to determine their vitamin D levels, thereby driving demand for testing services. The interplay between supplement use and testing is likely to create a synergistic effect, further propelling the vitamin d-testing market.

Increased Prevalence of Vitamin D Deficiency

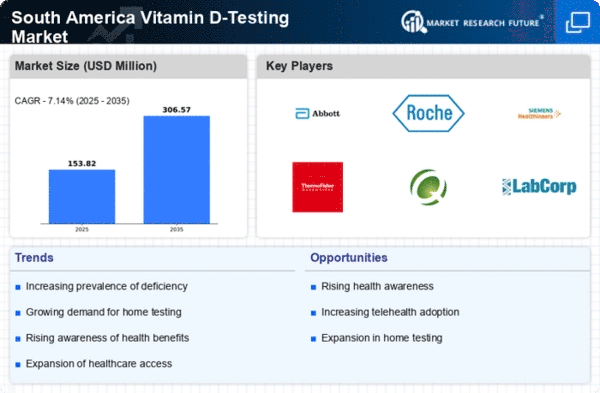

The rising incidence of vitamin D deficiency in South America is a critical driver for the vitamin d-testing market. Studies indicate that approximately 50% of the population in certain regions may be deficient in this essential nutrient. This deficiency is often linked to various health issues, including osteoporosis and cardiovascular diseases. As awareness of these health risks grows, individuals are increasingly seeking testing services to monitor their vitamin D levels. Consequently, healthcare providers are expanding their testing capabilities to meet this demand, thereby propelling the vitamin d-testing market forward. The emphasis on preventive healthcare is likely to further enhance the market, as more people recognize the importance of maintaining adequate vitamin D levels for overall health.

Influence of Social Media and Health Campaigns

The influence of social media and health campaigns in South America is increasingly shaping the vitamin d-testing market. With the rise of digital platforms, health awareness campaigns are reaching broader audiences, educating them about the importance of vitamin D. These campaigns often highlight the risks associated with deficiency and promote testing as a proactive measure. Recent surveys suggest that social media has become a primary source of health information for over 60% of the population. This trend is likely to encourage more individuals to seek vitamin D testing, as they become more informed about their health. The synergy between social media influence and health campaigns is expected to significantly boost the vitamin d-testing market in the coming years.