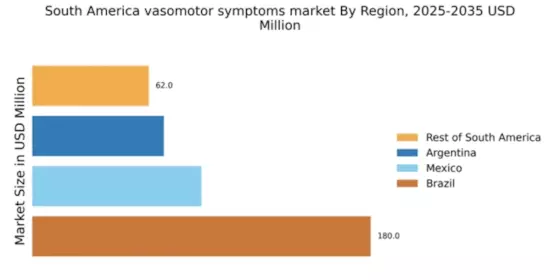

Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure in South America significantly drives the vasomotor symptoms market. Improved access to healthcare facilities and services enables more women to seek treatment for vasomotor symptoms. Governments and private sectors are investing in healthcare systems, which enhances the availability of specialized care for menopausal women. This development is crucial, as it allows for better diagnosis and management of symptoms, leading to increased patient satisfaction. Furthermore, the introduction of telemedicine services has made it easier for women to consult healthcare professionals regarding their symptoms. As healthcare infrastructure continues to grow, the vasomotor symptoms market is likely to experience substantial growth, with more women receiving the necessary support and treatment.

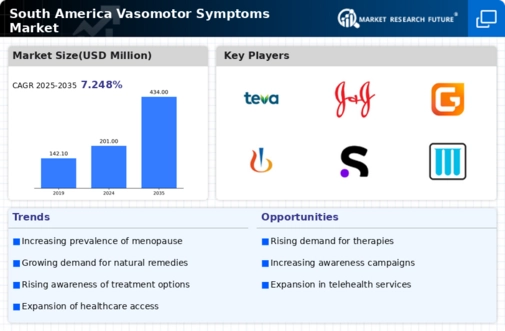

Rising Incidence of Menopausal Symptoms

The increasing incidence of menopausal symptoms among women in South America is a primary driver for the vasomotor symptoms market. As the population ages, a larger segment of women experiences vasomotor symptoms, such as hot flashes and night sweats. Recent estimates indicate that approximately 50% of women in this demographic report experiencing these symptoms, which significantly impacts their quality of life. This growing prevalence necessitates effective treatment options, thereby expanding the vasomotor symptoms market. Furthermore, the rising awareness of available therapies and the importance of addressing these symptoms contribute to market growth. The demand for both pharmaceutical and non-pharmaceutical interventions is likely to increase, as healthcare providers and patients seek solutions to manage these symptoms effectively.

Growing Demand for Personalized Medicine

The growing demand for personalized medicine in South America is influencing the vasomotor symptoms market. Patients increasingly seek tailored treatment options that consider their unique health profiles and preferences. This trend is particularly relevant for managing vasomotor symptoms, as individual responses to treatments can vary significantly. Healthcare providers are beginning to adopt personalized approaches, utilizing genetic and lifestyle information to guide treatment decisions. This shift not only enhances patient satisfaction but also improves treatment outcomes. As the market adapts to this demand, there is potential for the development of customized therapies that address the specific needs of women experiencing vasomotor symptoms. The emphasis on personalized medicine is likely to drive innovation and growth within the vasomotor symptoms market.

Cultural Shifts Towards Health and Wellness

Cultural shifts in South America towards health and wellness are influencing the vasomotor symptoms market. As societal attitudes evolve, there is a greater emphasis on women's health, particularly during menopause. This shift is reflected in increased discussions around vasomotor symptoms and their management. Women are more likely to seek medical advice and treatment options, leading to a higher demand for products addressing these symptoms. The market is projected to grow as healthcare providers adapt to these cultural changes and offer tailored solutions. Additionally, the rise of wellness programs and holistic approaches to health may further enhance the visibility of treatments for vasomotor symptoms, thereby expanding the market. This trend indicates a potential for innovative therapies and educational initiatives to flourish in the region.

Increased Research and Development Activities

Increased research and development activities in South America are propelling the vasomotor symptoms market forward. Pharmaceutical companies and research institutions are focusing on developing new therapies and treatment options for vasomotor symptoms. This surge in R&D is driven by the need for more effective and safer solutions, as existing treatments may not be suitable for all women. Recent studies have highlighted the potential of novel compounds and alternative therapies, which could reshape the treatment landscape. As these innovations emerge, they are expected to attract investment and interest from both healthcare providers and patients. The ongoing commitment to research in this area suggests a promising future for the vasomotor symptoms market, with the potential for groundbreaking advancements.