Aging Population

The demographic shift towards an aging population in South America significantly influences the vascular embolization market. As individuals age, the prevalence of vascular diseases, such as aneurysms and arteriovenous malformations, tends to increase. By 2025, it is estimated that over 15% of the population in South America will be aged 65 and older, creating a larger patient base requiring vascular interventions. This demographic trend necessitates the development and availability of effective treatment options, including embolization procedures. The vascular embolization market is likely to see a surge in demand as healthcare providers seek to address the unique needs of older patients, who often present with complex medical conditions. Additionally, the growing awareness of vascular health among the elderly population may lead to earlier diagnosis and treatment, further driving market growth.

Rising Awareness and Education

In South America, increasing awareness and education regarding vascular health are crucial drivers for the vascular embolization market. Public health campaigns and educational initiatives by healthcare organizations are enhancing knowledge about vascular diseases and the benefits of embolization procedures. As a result, patients are becoming more proactive in seeking treatment options. In 2025, surveys indicate that approximately 60% of the population is aware of minimally invasive procedures, compared to just 30% in previous years. This heightened awareness is likely to lead to increased consultations with healthcare providers and a subsequent rise in the demand for vascular embolization treatments. Furthermore, as more patients understand the advantages of these procedures, such as reduced recovery times and lower complication rates, the vascular embolization market is expected to experience robust growth.

Increasing Healthcare Expenditure

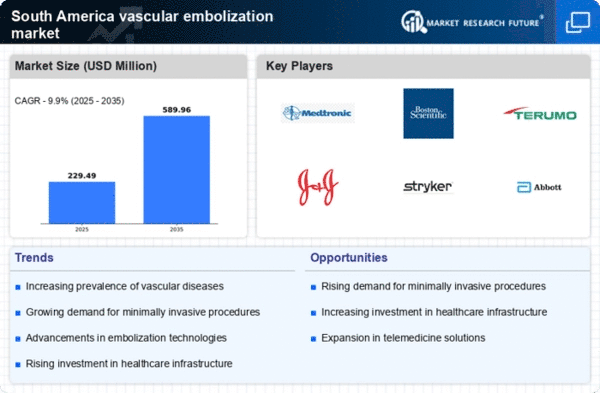

The rising healthcare expenditure in South America is a pivotal driver for the vascular embolization market. Governments and private sectors are investing more in healthcare infrastructure, which enhances access to advanced medical technologies. In 2025, healthcare spending in the region is projected to reach approximately $500 billion, reflecting a growth rate of around 5% annually. This increase in funding allows hospitals and clinics to acquire state-of-the-art embolization devices and training for healthcare professionals. Consequently, the vascular embolization market benefits from improved patient outcomes and expanded treatment options, as more facilities adopt these innovative procedures. Furthermore, as healthcare budgets grow, there is a greater emphasis on minimally invasive techniques, which are often associated with shorter recovery times and reduced hospital stays, further propelling the demand for vascular embolization solutions.

Supportive Regulatory Environment

A supportive regulatory environment in South America plays a vital role in fostering the growth of the vascular embolization market. Regulatory bodies are increasingly recognizing the importance of minimally invasive procedures and are streamlining the approval processes for new embolization devices. This trend is likely to encourage innovation and investment in the sector. In 2025, it is anticipated that the approval timelines for new medical devices will decrease by approximately 20%, facilitating quicker access to advanced treatment options for patients. Furthermore, regulatory support often includes guidelines that promote best practices in embolization procedures, enhancing safety and efficacy. As a result, healthcare providers are more inclined to adopt these technologies, thereby driving the demand for vascular embolization solutions in the region.

Technological Innovations in Medical Devices

Technological innovations in medical devices are transforming the landscape of the vascular embolization market in South America. The introduction of advanced embolization materials, such as bioresorbable particles and novel delivery systems, enhances the efficacy and safety of procedures. In 2025, the market for embolization devices is projected to grow at a CAGR of 7%, driven by these innovations. Additionally, the integration of imaging technologies, such as 3D imaging and real-time monitoring, allows for more precise and effective embolization procedures. As healthcare providers adopt these cutting-edge technologies, patient outcomes improve, leading to increased satisfaction and a higher likelihood of recommending these treatments. Consequently, the vascular embolization market is poised for significant expansion as technological advancements continue to shape the future of vascular interventions.