Emergence of IoT Devices

The unified endpoint-management market in South America is increasingly shaped by the emergence of Internet of Things (IoT) devices. As organizations integrate IoT technologies into their operations, the complexity of managing these diverse endpoints escalates. The market is projected to grow by approximately 10% as businesses seek unified solutions to manage not only traditional endpoints but also a myriad of IoT devices. Unified endpoint management systems are essential for ensuring the security and functionality of IoT devices, which often present unique challenges in terms of connectivity and data management. The emergence of IoT devices is likely to drive innovation in the unified endpoint-management market, as companies look for ways to streamline their endpoint management processes.

Expansion of Mobile Device Usage

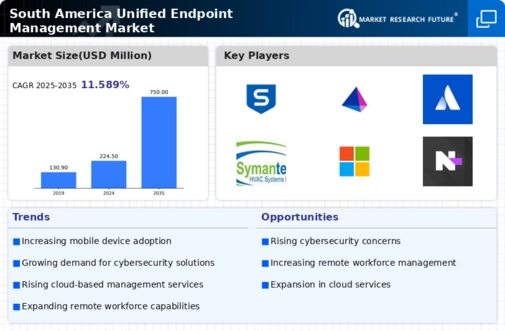

The unified endpoint-management market in South America is witnessing a significant expansion driven by the increasing usage of mobile devices. With mobile devices becoming integral to business operations, organizations are recognizing the necessity of managing these endpoints effectively. The market is anticipated to grow at a rate of approximately 14% as businesses seek solutions that provide comprehensive management of mobile devices alongside traditional endpoints. Unified endpoint management systems enable organizations to secure, monitor, and manage mobile devices, ensuring that corporate data remains protected. This expansion of mobile device usage is likely to catalyze further advancements in unified endpoint-management technologies, as companies strive to enhance their mobile security posture.

Growing Focus on Regulatory Compliance

In South America, the unified endpoint-management market is significantly influenced by the increasing emphasis on regulatory compliance. Organizations are compelled to adhere to various data protection laws and industry regulations, which necessitate robust endpoint management strategies. The market is projected to grow by around 12% as companies invest in solutions that ensure compliance with regulations such as the General Data Protection Regulation (GDPR) and local data protection laws. Unified endpoint management systems play a crucial role in helping organizations maintain compliance by providing visibility and control over endpoints, thereby mitigating risks associated with data breaches and non-compliance penalties. This growing focus on regulatory compliance is expected to propel the adoption of unified endpoint-management solutions across various sectors.

Rising Demand for Remote Work Solutions

The unified endpoint-management market in South America experiences a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for effective management of diverse endpoints becomes paramount. This trend is reflected in a projected growth rate of approximately 15% annually in the region. Companies are seeking solutions that enable secure access to corporate resources from various devices, ensuring productivity and collaboration. Unified endpoint management systems facilitate this by providing centralized control over devices, applications, and data, thereby enhancing operational efficiency. The rising demand for remote work solutions is likely to drive innovation and investment in the unified endpoint-management market, as businesses strive to adapt to evolving work environments.

Increased Investment in Digital Transformation

In South America, the unified endpoint-management market is benefiting from the increased investment in digital transformation initiatives. Organizations are recognizing the need to modernize their IT infrastructure to remain competitive, leading to a projected market growth of around 13%. This investment often includes the adoption of unified endpoint management solutions that facilitate the integration of various technologies and streamline operations. By centralizing endpoint management, organizations can enhance their agility and responsiveness to market changes. The increased investment in digital transformation is likely to propel the demand for unified endpoint-management solutions, as businesses seek to optimize their IT environments and improve overall efficiency.