Rising Demand for Data Analytics

The South America Time And Attendance Software Market is witnessing a rising demand for data analytics capabilities within time and attendance solutions. Organizations are increasingly leveraging data to make informed decisions regarding workforce management. In 2025, it is projected that 35% of companies in South America will utilize advanced analytics to optimize labor costs and improve operational efficiency. This trend highlights the importance of integrating data analytics into time and attendance software, enabling businesses to gain insights into employee performance and attendance patterns. As companies seek to enhance their decision-making processes, the demand for analytics-driven time and attendance solutions is likely to grow.

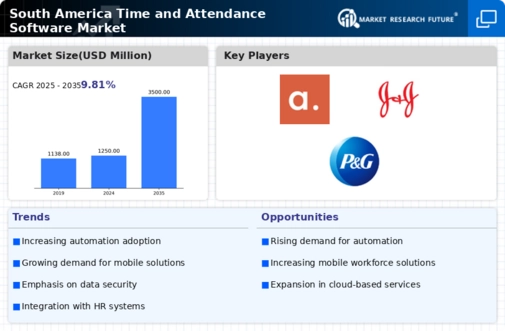

Growing Workforce Management Needs

The South America Time And Attendance Software Market is experiencing a surge in demand due to the increasing need for effective workforce management. As companies expand and diversify, the complexity of managing employee schedules, attendance, and productivity rises. In 2025, the workforce in South America is projected to grow by approximately 3%, leading to a heightened focus on optimizing labor resources. Organizations are increasingly recognizing the value of time and attendance software in streamlining operations, reducing labor costs, and improving overall efficiency. This trend indicates a robust growth trajectory for the market as businesses seek to enhance their operational capabilities.

Regulatory Compliance and Labor Laws

The South America Time And Attendance Software Market is significantly influenced by the region's complex labor laws and regulations. Countries such as Brazil and Argentina have stringent labor regulations that mandate accurate tracking of employee hours and attendance. This compliance requirement drives organizations to adopt sophisticated time and attendance solutions to avoid legal penalties. In Brazil, for instance, the Ministry of Labor enforces strict guidelines on employee working hours, which necessitates the use of reliable software. As businesses strive to adhere to these regulations, the demand for time and attendance software is expected to grow, thereby enhancing the market's overall landscape.

Increased Focus on Employee Well-being

The South America Time And Attendance Software Market is increasingly shaped by a growing emphasis on employee well-being and work-life balance. Organizations are recognizing that flexible working hours and accurate attendance tracking contribute to higher employee satisfaction and retention rates. In 2025, studies indicate that companies prioritizing employee well-being are likely to see a 20% increase in productivity. As a result, businesses are investing in time and attendance software that allows for flexible scheduling and remote work options. This shift towards a more employee-centric approach is expected to drive market growth as organizations seek to create a supportive work environment.

Technological Advancements and Integration

The South America Time And Attendance Software Market is poised for growth due to rapid technological advancements. The integration of artificial intelligence and machine learning into time and attendance solutions is transforming how organizations manage employee data. These technologies enable more accurate tracking, predictive analytics, and enhanced reporting capabilities. In 2025, it is estimated that over 40% of companies in South America will adopt AI-driven time and attendance systems, reflecting a shift towards more intelligent workforce management solutions. This trend not only improves operational efficiency but also positions businesses to adapt to changing market demands.